- Top

- Investor Relations

- Management Policy

- Corporate Governance

- Communication (Dialogue) with Shareholders; Securing Shareholders’ Rights

Communication (Dialogue) with Shareholders; Securing Shareholders’ Rights

Last update: May 30, 2025

1. Dialogue with shareholders and IR/SR activity policy [CGC Principle 5.1]Updated

Activities led by the IR·SR Department are carried out to ensure that shareholders, investors and other stakeholders have a deeper understanding of the Group’s management strategy to realize its vision and, in turn, that they have high expectations for the enhancement of both corporate value and shareholder value through the sustainable growth of the Company.

(1) Basic Policy on Constructive Dialogue with Shareholders and Investors

Constructive dialogue with shareholders and investors contributes to the increase in corporate value over the medium to long term and sustainable growth of the Company. Our policy on such dialogue is determined by the Board of Directors.

- 1. The Company has a dedicated department (the Investor & Shareholder Relations Department) responsible for planning and execution of activities for dialogue with shareholders and investors.

- 2. The Investor & Shareholder Relations Department is responsible for overall dialogue with shareholders and investors, and the president is in charge of it. The president, directors, and so forth strive to meet with shareholders and investors personally to the extent reasonable, in accordance with their wishes and the main topics of dialogue.

- 3. The Investor & Shareholder Relations Department has regular meetings with the relevant departments to promote smooth dialogue with shareholders and investors. The meetings facilitate the cooperation within the Company, such as information sharing, and the department also conducts appropriate exchange of information with the respective operating companies.

- 4. The opinions, wishes, concerns, and so forth gathered through dialogue with shareholders and investors are reported to management and the Board of Directors meetings as required, so that they can be reflected in management activities and business operation.

- 5. The Company holds the Shareholders' Meetings and individual meetings, as well as proactive quarterly financial results briefings and briefings at operating companies. In addition, the Company advances constructive dialogue to increase corporate value regarding the medium to long term management strategies, capital policies, corporate governance, responses to environmental and social issues, and so forth with the shareholders recorded in the shareholders' registry and the shareholders who effectively hold the Company's shares. In doing so, the Company strives to promote deeper understanding of its management activities and business operations among shareholders and investors.

- 6. To ensure that material information is not selectively presented only to certain people in the dialogue with shareholders and investors, the Company has determined the basic policy on information disclosure, and rigorously manages material information.

Further, the information management supervisor of the Company is appointed and strives to prevent external leakage of material information and insider trading. - 7. The Company regularly assess the shareholder composition on the shareholders' registry. In addition, the Company conduct a survey to determine the shareholders who effectively hold the Company's shares and use the results for constructive dialogue with shareholders and investors.

Annual IR/SR schedule (FY2024)

| Q1 | Mar. | SEVEN-ELEVEN JAPAN CO., LTD. (SEJ) Merchandising Strategy Presentation |

|---|---|---|

| Apr. | Financial Results Presentation for the Fiscal Year (Hybrid), Small Financial Results Meeting, IR Day, Overseas Roadshow | |

| May | Overseas Roadshow, Annual Shareholders' Meeting | |

| Q2 | Jun. | Securities Company Conference |

| Jul. | Financial Results Presentation for Q1 (Teleconference), Small Financial Results Meeting | |

| Aug. | ||

| Q3 | Sep. | Securities Company Conference, SEJ Merchandising Strategy Presentation |

| Oct. | Financial Results Presentation for Q2 (Teleconference), Small Financial Results Meeting, IR Day | |

| Nov. | Overseas Roadshow, Securities Company Conference | |

| Q4 | Dec. | |

| Jan. | Financial Results Presentation for Q3 (Teleconference), Small Financial Results Meeting | |

| Feb. |

Dialogue with Shareholders and Investors: Track record (FY2024)

Activities led by the IR·SR Department are carried out to ensure that shareholders, investors, and other stakeholders have a deeper understanding of the Group’s management strategy to realize its vision and, in turn, that they have high expectations for the enhancement of both corporate value and shareholder value through the sustainable growth of the Company.

In FY2024, the Company held a financial results briefing, IR Days, overseas roadshows, group meetings, and other events. We also provided opportunities for dialogue between the management team and external directors, and the shareholders and investors in accordance in response to requests from the latter.

| Occasions | Results | Activities |

|---|---|---|

| Financial Results Presentation | 4 times |

|

| Group Meetings | 16 times |

|

| Conference Organized by Security Companies | 6 times |

|

| IR Day | 2 times |

|

| Overseas Roadshow | 2 times |

|

| Interviews | 475 companies |

|

| (Domestic institutional investors, etc.) | 239 companies | |

| (Overseas institutional investors, etc.) | 236 companies | |

| Business Presentations | 2 times |

|

Major Themes of Dialogue (FY2024)

| Major Themes | Specifics | |

|---|---|---|

| The Company's Standalone Management Measures |

|

|

| Acquisition Proposal by Alimentation Couche-Tard(ACT) |

|

|

| Performance Related Issues |

|

|

| Sustainability Related Issues | Environment |

|

| Social |

|

|

| Governance |

|

|

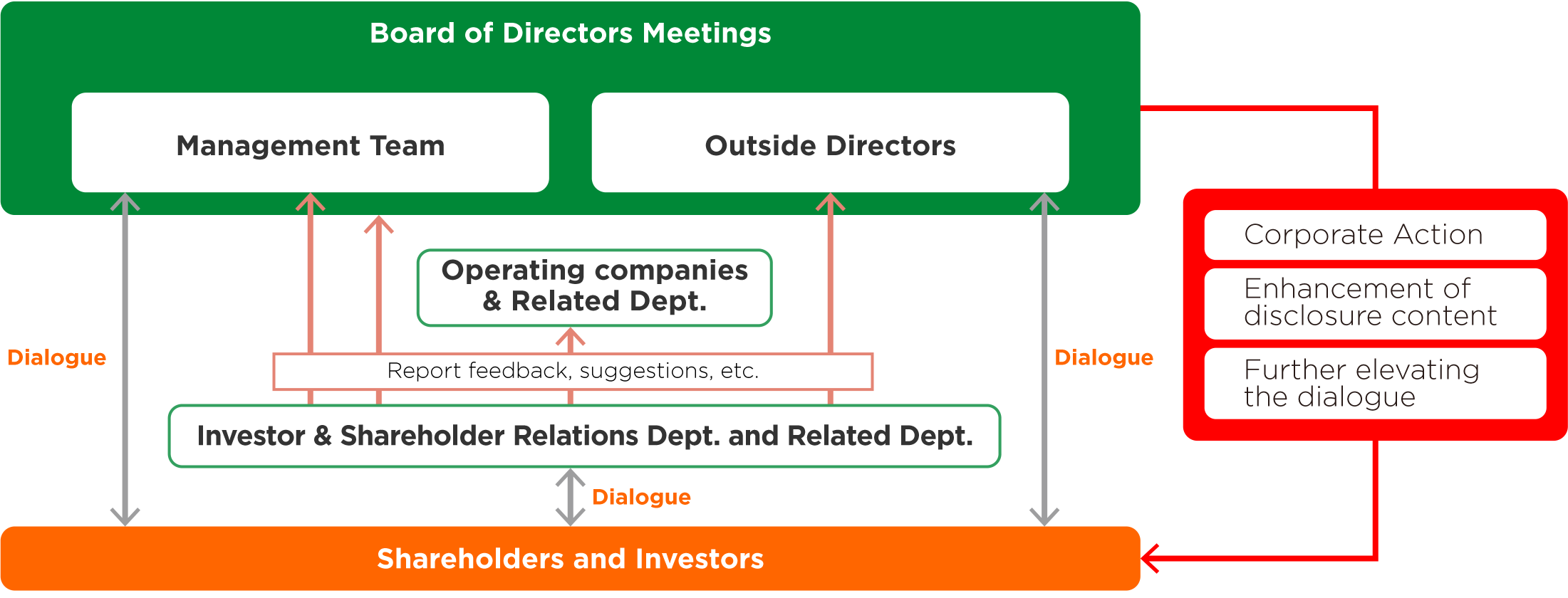

The Cycle of Enhancing Corporate Value through Investor Engagement

- The management team and individual business unit heads engage in dialogue with domestic and international shareholders and institutional investors through one-on-one meetings, overseas roadshows, group meetings and IR Days.

- Feedback and opinions received from shareholders and institutional investors are regularly reported to management and the Board of Directors and are discussed at Board meetings to be incorporated into corporate actions.

The Cycle of Enhancing Corporate Value through Investor Engagement

Feedback to Management and Board of Directors

| Major Report Content | Results | Topics |

|---|---|---|

| Quarterly Regular Report | 4 times | Reported on analysts’ forecast, stock price trends, etc. |

| Financial Results Briefing Status Report | 4 times | Reported on the main areas of interest of participants, in addition to analyst reports |

| Overseas Roadshow Status Report | 2 times | Reported on major concerns, opinions and dialogue contents from shareholders and investors |

| IR Day Status Report | 2 times | Reported on the main areas of interest of participants, in addition to analyst reports |

| Others | Timely basis | Reported on the main areas of interest of shareholders and investors, including their comments |

External recognitionUpdated

- Daiwa Investor Relations Internet IR Commendation Award 2024

- Nikko Investor Relations: All Japanese Listed Companies' Website Ranking in 2024; Overall: Best website; By industry: Best website

- Gomez: IR Website Ranking in 2024; Excellent Company: Gold Award (Retailing)

- *Click here for prior years [PDF:400KB]

(2) Basic Policy on Information Disclosure

The Company's basic policy is to provide fair and highly transparent information disclosure to shareholders, investors, and all other stakeholders. To obtain a correct evaluation of its corporate value, the Company conducts proper information disclosure in line with applicable laws and regulations as well as securities exchange listing rules. Moreover, to assist all stakeholders to deepen their understanding of the Company, we also strive to actively disclose information judged likely to have an impact on shareholder and investor decisions, even if the information is not subject to disclosure obligations under applicable laws and regulations or securities exchange listing rules.

1. Standard for Disclosure

The Company considers the following information to require disclosure.

- iInformation for statutory or timely disclosure

Information requiring disclosure under laws and regulations such as the Financial Instruments and Exchange Act and the Companies Act

Information requiring disclosure under the securities exchange listing rules, such as those set out by the Tokyo Stock Exchange - iiInformation for discretionary disclosure

Information that is likely to have an impact on shareholders and investors investment decisions, even though it is not information described in (i).

2. Information Disclosure Methods

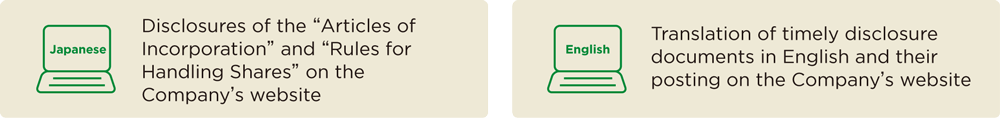

Statutory disclosures under the Financial Instruments and Exchange Act are disclosed through EDINET (electronic disclosure system for disclosure documents such as annual securities reports in accordance with the Financial Instruments and Exchange Act), while information disclosures required by securities exchange listing rules and so forth are disclosed through TDnet (timely disclosure information transmission system provided by the Tokyo Stock Exchange). In principle, all disclosures are also promptly posted on the Company's website. Timely disclosure materials are also provided in English, so that information can be disclosed fairly and promptly not only with in Japan, but also to overseas markets. Discretionary disclosures are made appropriately, such as by posting on the Company's website. The Company strives to help stakeholders gain a deeper understanding of its businesses by holding business strategy briefings for domestic analysts and institutional investors and publishing an Integrated Report, Corporate Outline, and so forth.

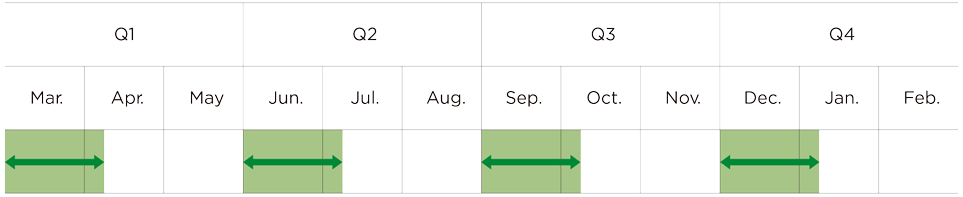

3. Quiet Period

The Company observes a quiet period from the day following the financial closing date until the day of announcement of financial results in order to prevent financial information leaks and ensure fair disclosure. During this period, the Company refrains from making comments or answering questions regarding its financial results.

However, even during the quiet period, the Company will respond to inquiries regarding information that does not relate to its financial results or information that has already been publicly disclosed.

Moreover, if any major event requiring disclosure under the securities exchange listing rules and so forth occurs during the quiet period, for example if the results are expected to deviate significantly from the earnings forecast, the Company makes a public announcement appropriately in line with the securities exchange listing rules and so forth.

Quiet period

4. Forward-Looking Statements

The information disclosed by the Company may contain forward-looking statements. These statements are based on management's judgment in accordance with materials available to the Company at the time of disclosure, with future projections based on certain assumptions. The forward-looking statements therefore incorporate various risks, estimates, and uncertainties, and as such, actual results and performance may differ from the future outlook included in disclosed information due to various factors, such as changes in business operations and the financial situation going forward.

Enhancing disclosure and communication for individual shareholders and investors

The Company has been employing various methods to enhance disclosure and communication for individual shareholders and investors.

(i) Website for individual shareholders and investors

https://www.7andi.com/ir/individual/

(in Japanese only)

The Company has a dedicated website for individual shareholders and investors that clearly and comprehensively communicates explanations of business and other information of the Group.

(ii) “Quarterly Report” Shareholder Newsletter

https://www.7andi.com/group/quarterly.html

(in Japanese only)

Every three months, the Company publishes a newsletter for its shareholders that sheds light on the latest initiatives of the Group and each Group company, covering various topics in each issue.

2. Securing shareholders' rights at Shareholders' Meetings

(1) Initiatives to secure the rights and substantial equality of shareholders

The Company makes effort to secure the rights and substantial equality of shareholders. The Company strives to secure the substantive rights of non-Japanese and minority shareholders, in terms of securing an environment where they can exercise their rights and enjoy substantial equality.

Anti-takeover measures

Adoption of anti-takeover measures: None

At present, the Company has not clearly defined "basic policies regarding the way a person is to control the determination of financial and business policies of the stock company" (Article 118, (iii), Regulation for Enforcement of the Companies Act). However, with the aim of maximizing the Group's corporate value through the further improvement of business performance and strengthening of corporate governance, etc., the Company believes it to be necessary to appropriately address large-scale purchases of the shares of the Company, and other acts which may damage the Group's corporate value. The Company will continue to carefully consider these basic policies, in light of future trends in legislation and court decisions, etc., as well as social trends.

(2) Shareholders' Meetings

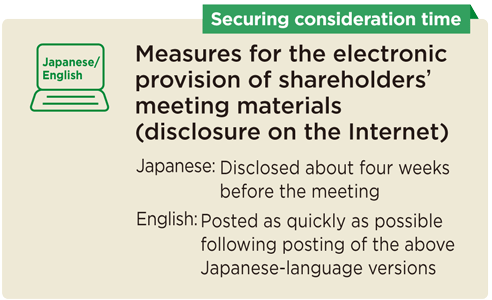

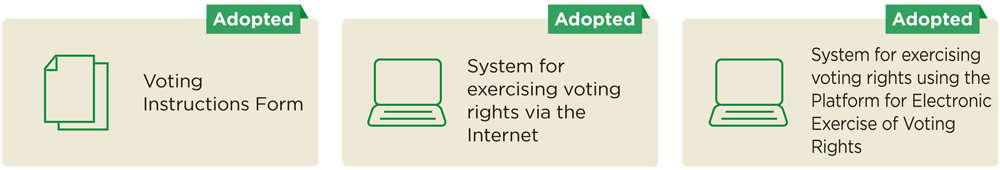

The Company takes measures from the following perspectives to substantially secure the voting rights and other rights of shareholders at the Shareholders' Meetings. Voting results for each proposal at Shareholders' Meetings are confirmed by the Board of Directors after the meeting. In cases where the proportion of opposing votes exceeds a certain level, the Board undertakes a causal analysis and discusses its response.

Shareholders' Meeting Materials (Electronic Provision System )

System for exercising voting rights

Shareholders' Meeting venue