- Top

- Investor Relations

- Management Policy

- Risk Factors

Risk Factors

Last update: September 1, 2025

Seven & i Holdings strives to appropriately manage various risks through practical and effective measures in order to enhance corporate value and maintain the continuous development of the Group. Among the risks identified through these efforts, those that may have a significant influence on the decisions of investors based on the likelihood of the risk materializing, the timing of the risk, and the degree of impact are described below. However, these do not cover all risks related to the Group; there are risks other than those listed that are difficult to foresee. Also, these risks are not independent of each other, and certain events may lead to an increase in various other risks. This section includes forward-looking statements and future expectations of the Group as of the submission date of the Group’s Securities Report.

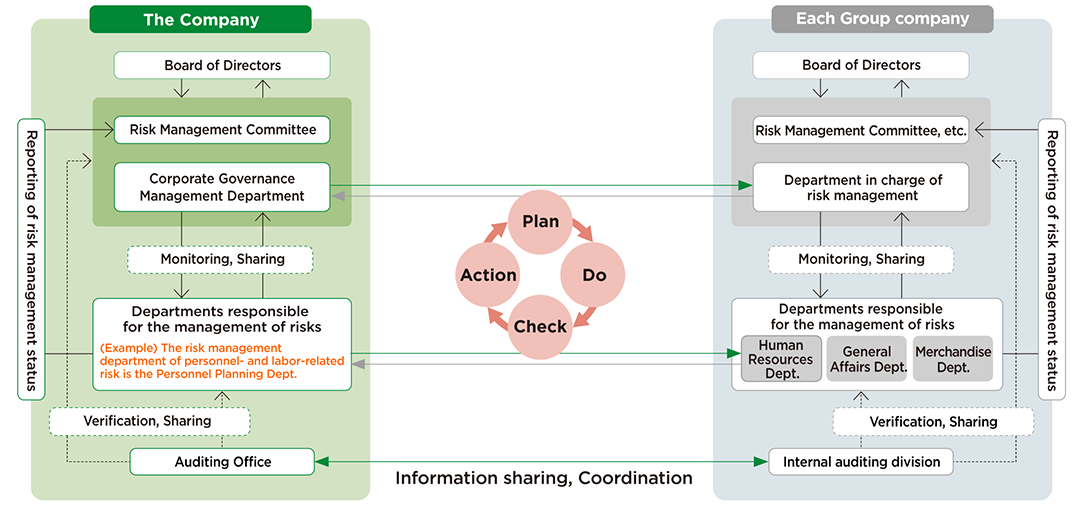

Group risk management system

The Company and Group companies have established a Risk Management Committee. As a general rule, the Risk Management Committee meets once every six months to receive reports on the risk management status of the respective companies from the departments responsible for the management of risks, to comprehensively identify, assess, and analyze risks and discuss measures, and to determine the future direction going forward.

Meanwhile, with regard to various risks, Group policies related to such risks, initiatives to mitigate risks undertaken by each company, and various internal and external examples illustrating signs of materializing risks, etc., are shared through a group-wide meeting body, etc., headed by the Company’s departments responsible for the management of risks.

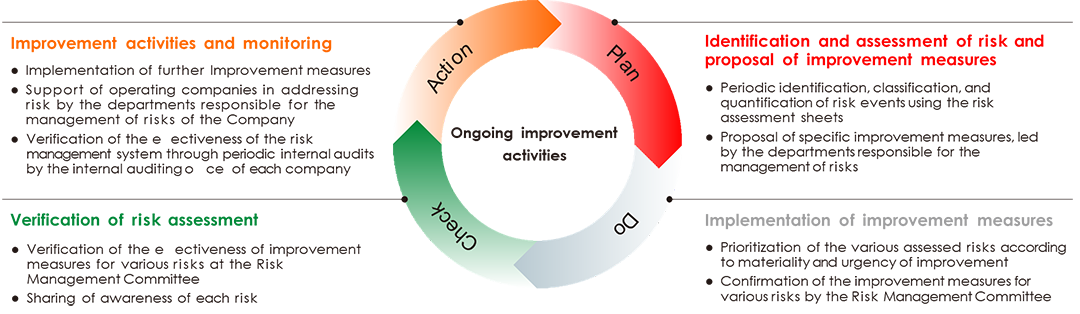

PDCA for risk management

The Group conducts risk management based on information from inside and outside the Group, through “the comprehensive identification of risks,” “risk assessment and proposal of improvement measures,” “prioritization of risks,” and “improvement activities and monitoring.”

In addition, the Auditing Office of each company verifies whether risk management is being conducted effectively, from an independent perspective, through periodic internal audits, and provides each department with advice for improving risk management, as required.

Group growth strategy and risk situation

For the Medium-Term Management Plan (2021-2025), the Group has formulated Group growth strategies around its strengths in “food,” and promotes enterprise risk management to provide a foundation to support these growth strategies. The following is a description of the risk situation as it pertains to the main businesses that constitute the growth strategy.

- 1North America Convenience Store Operations

In order to drive further growth for the Group, 7-Eleven, Inc. is working to strengthen proprietary merchandise, promote digitalization and delivery measures, enhance efficiency and cost leadership, and grow and enhance store networks.

With regard to the strengthening of proprietary products that are a pillar of the growth strategy, we are taking steps to broaden the range of categories offered and develop new products, to enhance the food value chain, and to improve quality and lineups, but logistics disruptions, food safety problems, and the issue of competition with fast food chains and other rivals could affect the performance and financial standing of the Group.

In terms of promoting digitalization and delivery initiatives, these include the expansion of the 7Rewards loyalty program and the 7NOW delivery network, but in the event that information security problems occur or that we are unable to respond to customer needs, the performance and financial standing of the Group could be affected.

With regard to enhancing efficiency and cost leadership, in order to achieve successive reductions in costs and improvements in efficiency we are introducing our unique item-by-item management POS system and fuel system in all Speedway stores with the aim of boosting both sales and gross profits and streamlining store management. However, in the event that changes in the business environment or competitive situation prevent growth opportunities or efficiency gains from being realized, the performance and financial standing of the Group could be affected.

In the North American convenience store operations, we aim to increase market share through M&A, strengthen store operations, and develop new standard stores. However, the performance and financial standing of the Group may be affected by the impact on the business of intensifying competition or changes in environmental laws and regulations, difficulties in securing personnel, litigation, law and order problems, and climate change and natural disasters. - 2Global Convenience Store Operations

7-Eleven International LLC will strengthen cooperation with 7-Eleven, Inc. and SEVEN-ELEVEN JAPAN CO., LTD. with the long-term objective of operating 100,000 stores in 30 countries and regions worldwide by 2030. To accelerate its entry into new markets, 7IN is implementing a strategic process that spans market selection to partner selection and determination of the entry model, while for existing markets it will improve performance gaps between markets and raise the proportion of proprietary products to support the transformation into a food-focused convenience store. It is also accelerating business growth in key markets through strategic investments.

However, the development of the business in overseas areas is expected to be affected by political and social instability, economic fluctuations such as exchange rates and trade, and the revision and strengthening of legal regulations, including those related to the environment and data protection. If these factors limit our growth potential and prevent us from realizing the benefits and profits we initially anticipated, the performance and financial standing of the Group could be affected. - 3Domestic Convenience Store Operations

In order to further develop the operations of the domestic convenience stores that are the foundation of the Group’s growth, SEVEN-ELEVEN JAPAN CO., LTD. is enhancing its ability to respond to change, which is the driving force behind this expansion. In the food sector, we are addressing the polarization of consumption by rolling out a three-tiered price strategy covering everything from high-value-added items of superior quality to staple goods that are felt to be good value. By working on our “Pleasant Value! Declaration” initiative of providing products at an affordable price while maintaining our commitment to taste and quality, we aim to increase the pull factor of our stores. In terms of services, we are providing new experience value through the promotion of the 7NOW delivery service nationwide. Our efforts to address the social issue of food waste and other environmental problems are centered on the “Eco-Price initiative”. With regard to store openings, in addition to ensuring urban development through high-quality stores opened under even stricter criteria, we will continue to close or relocate underperforming stores. However, we will work with the authorities to open compact stores in areas where other stores and offices have been closed in order to create buying opportunities for those having difficulty shopping. Furthermore, we have opened a store at World Expo 2025 (Osaka Kansai Banpaku) to exhibit the urban lifestyle of the future and enable visitors to experience for themselves a health-focused lifestyle. As well as providing economic value, these measures offer social value that helps to resolve some of the issues of society.

However, customer needs change unceasingly, and in the event that we are unable to provide new value, the performance and financial standing of the Group could be affected.

Progress in these key strategies of the Group is monitored by the Board of Directors, a majority of the members of which are independent outside directors.

Risk assessment process

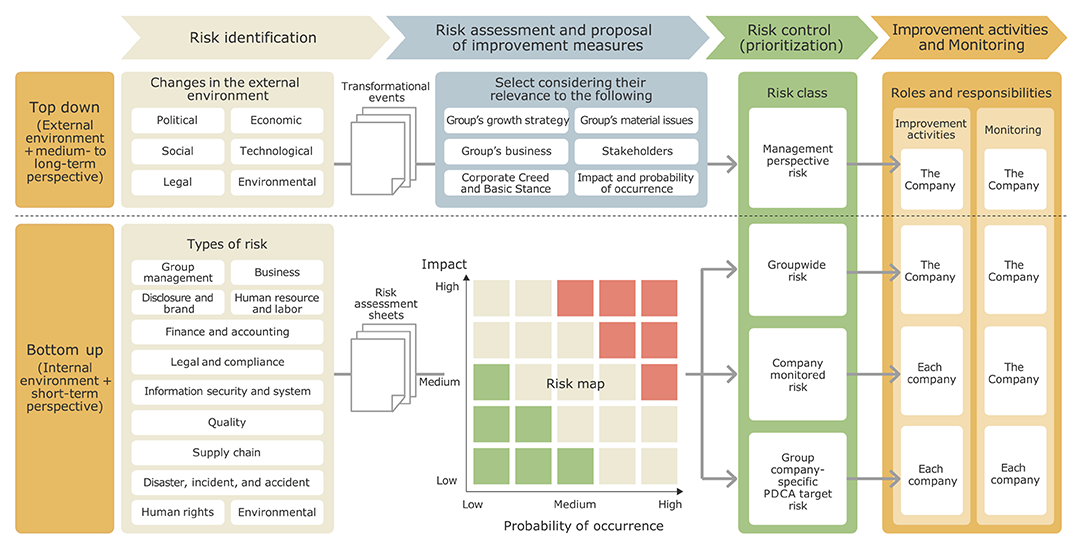

In addition to changes in the internal environment of the Group, there is a need to recognize global shifts in trend such as heightened geopolitical and ESG-related risks, and various alterations in the business environment including changes in consumer values and the growth of online shopping.

In recent years in particular, there has been a rise in factors that heighten the uncertainty of the environments in which corporate activities take place, such as the unpredictable international situation.

In response to these conditions, we have added external environment risks and medium- to long-term risks, alongside the internal environment and short-term risks that had previously been the focus of our risk management efforts, as well as maintaining and expanding risk categories to enable us to address changes in the internal and external environments. Moreover, from the perspective of assessing the degree of impact on performance arising from the emergence of risk, by adding qualitative elements such as business continuity, damage to the Group’s brand image, and other factors to the quantitative factors previously considered, we seek to take a more multifaceted and sophisticated approach to assessment and analysis of all risks.

In addition, having formed a comprehensive judgment of each risk from the perspectives of significance, commonality, the degree of emergence, and efficiency, we divide them into four classes of risk. The roles and responsibilities of the Company and each company in the Group are clarified for each risk class, and improvement activities for various risks are carried out by the entities responsible for them, thereby enhancing the effectiveness of risk management for the Group as a whole.

| Risk class | Definition | Roles and responsibilities | |

|---|---|---|---|

| Improvement activities | Monitoring | ||

| Management perspective risk | Risks that have a high impact on the Group in the medium- to long-term, and are characterized by requiring a unified approach for the Group as a whole | The Company | The Company |

| Groupwide risk | Risks that are common across the Group as a whole, relatively high, and characterized by requiring cross-group action from the perspective of efficiency of risk measure | The Company | The Company |

| Company monitored risk | Risks that are relatively high and that should be addressed by each company | Each company | The Company |

| Group company-specific PDCA target risk | Risks other than those described above that should be addressed by each company | Each company | Each company |

Major risks to the Group

Based on assessment and analysis of various risks, significant risk events that would be expected to have an impact on the growth strategy, performance, or financial standing of the Group are as follows.

- 1Medium- to long-term perspective risk (Management perspective risk)

After identifying change events that are anticipated to occur in the external environment over the medium to long term, and assessing their relevance to the growth strategies, material issues, nature of business, stakeholders, and other aspects of the Group, change events that could have a medium- to long-term impact on the growth strategies and sustainability of the Group if they were to occur in the future are designated as events in the category of management perspective risks (emerging risks). For each risk a risk owner (responsible department) is selected, which proceeds to investigate anticipated scenarios and measures. Trends in these change events are also monitored periodically and updated, and their measures are revised as necessary.

By monitoring for the occurrence of anticipated scenarios, we seek to detect risks at an early stage, initiate measures promptly, and control the impact on the Group. Decisions on risk measures (risk taking/risk hedging) will continue to be taken at a level of management that takes into consideration such factors as the growth strategy and material issues of the Group.

Management perspective risks (change events) identified at this point in time are as described in the following table.No. Classification Management perspective risk (change events) Anticipated Risk scenarios 1 Politics Political change, disruption, dysfunction Changing and strengthening of laws and regulations following changes of government or of policies in countries in which we have opened stores may have an impact on business licenses and the taxation regime, customs, foreign exchange rates, and other matters. In addition, political disruption, political dysfunction, economic crises, and other factors could lead to social instability and changes in market demand and the competitive environment. 2 Collapse of security due to conflict, etc. The health and safety of customers, employees, and others may be threatened as a result of outbreaks of conflict in countries in which we have opened stores, or due to them being embroiled in such crimes as terrorism, violence, and kidnapping. In addition, the destruction or looting of assets such as stores, logistics facilities, product supply networks, and product warehouses could make the continuation or recovery of the business infeasible. 3 Economy Decline of demand for gasoline In countries with restrictions on the sale of gasoline vehicles or where the shift to electric vehicles (EV), etc. is progressing, earnings obtained from the sale of gasoline may decline in future, and there might also be a decline in the number of customers visiting stores that have gasoline filling stations. Such a scenario might require changes to the business, and could incur costs in order to comply with relevant laws and regulations, or to increase the number of facilities, etc. for EV charging, and so on. 4 Society Food crises For a variety of reasons, including natural disasters, abnormal weather related to climate change, pandemics, crop pests and diseases, and violent conflict, shortages of raw materials could occur globally or in specific regions, which could make the stable supply of products infeasible. 5 Human resources/ manpower shortage Wage inflation, insufficiently developed labor environments, changing demographics, and other factors could have a serious impact on our ability to secure human resources and labor, such as producers in the agricultural, fishery, and livestock sectors, and employees engaged in food production facility, delivery, and store operations. 6 Growing demands for respect for human rights If we are unable to demonstrate respect for the human rights of our various stakeholders, this could lead to a backlash from consumers and society, leading to a situation in which we have no choice but to discontinue product supply and services. 7 Technology Acceleration of technological innovation (including AI) to improve productivity in logistics and store operations A variety of technologies such as automated driving and store automation are making advances on a yearly basis. While the introduction of such new technologies could lead to the streamlining of operations and improvements in efficiency on the one hand, on the other hand it could lead to increases in costs associated with complying with laws and regulations, responding to changes in business operations, and making capital investments. 8 Environmental Acceleration of decarbonization In the event that the Group fails to make progress in its decarbonization initiatives, this could lead to an increase in the burden of taxation, emissions trading, and costs associated with procurement of the energy required for business operations. The Group could also lose trust and reputation among consumers and in society, which could affect business profits. 9 Growing demand for mitigation of environmental impact of food supply chain In the event that the Group fails to make progress in its initiatives for mitigating the environmental impact of the food supply chain as a whole, it could result in an increase in the burden of costs associated with changes in production methods, means of delivery, and container and packaging materials. The Group could also lose trust and reputation among consumers and in society, which could affect business profits. 10 Growing demands for reductions in food waste In the event that food demand forecasting and inventory management do not function adequately, a failure to make progress in initiatives for reducing food waste could lead to an increase in costs associated with the disposal or return of foods and increase in environmental impacts. The Group could also lose trust and reputation among consumers and in society, which could affect business profits. For some of the management perspective risks (change events) described above, a risk owner (responsible department) has been selected, and various initiatives are being implemented.

The following are examples of such initiatives.Main examples of initiatives related to “6 Growing demands for respect for human rights” (risk owner: Human Rights Promotion Project)

- Formulation and promotion of human rights policy

- Implementation of human rights due diligence

- Assessment of impact of human rights (identifying human rights risks and creating human rights risk map)

- Implementation of prevention and remedial measures (education and training for employees, awareness-raising activities for business partners, establishing of internal environment and systems)

- Implementation of monitoring (culture & engagement surveys, questionnaire surveys for business partners, CSR audits of factories at which the Group’s original products are manufactured)

- Establishment of grievance mechanism and measures for redress (Groupwide Employee Helpline, Business Partner Helpline, Audit & Supervisory Board Hotline)

- Initiatives to prevent customer harassment (creation of guidelines and manuals to address, implementation of training)

Main examples of initiatives related to “7 Acceleration of technological innovation (including AI) to improve productivity in logistics and store operations” (risk owner: Group DX Division)

- Promote understanding of generative AI (introductory training, training in prompt engineering)

- Recruitment and training of DX human resources in each department

Main examples of initiatives related to “8 Acceleration of decarbonization” (risk owner: Sustainability Development Office)

- Establishment of new company with the aim of expanding procurement of renewable energy

- Promotion of energy-saving by employees (holding of group-wide “Energy Saving Contest,” etc.)

- Promotion of energy-saving and energy-generation facilities in stores (installation of large solar power generation, etc.)

- Commencement of trial test on “100% renewable energy store,” etc.

- Long-term procurement of electricity derived exclusively from power plants using renewable energy such as solar and wind (offsite PPA, etc.)

Main examples of initiatives related to “9 Growing demand for mitigation of environmental impact of food supply chain” (risk owner: Sustainability Development Office)

- Identify important raw materials from the perspectives of the volume handled, and dependencies and impacts on nature, and analyze and formulate measures to address the risks and opportunities of the place of production

- Procure products that are guaranteed to be sustainable

- Monitor the impact on the Group of new materials, the latest technologies, and the latest trends in laws and regulations for environmentally friendly containers and packaging, etc.

- Share and roll out some GREEN CHALLENGE 2050 initiatives throughout the supply chain as a whole

Main examples of initiatives related to “10 Growing demands for reductions in food waste” (risk owner: Sustainability Development Office)

- Initiatives for the supply chain as a whole

- Initiatives for the reduction of food waste at each company (promotion of Eco-Price discounted sales, donations to food bank organizations, etc.)

- Initiatives for environmental recycling-oriented agriculture (founding of Seven Farm Co., Ltd.), etc.

- 2Short-term perspective risk

After coming to a decision based on a comprehensive consideration of the degree of impact, likelihood of occurrence, and other aspects of the various risks identified by the Company and Group companies, we select risk events that should be managed by the Company and monitor the status of various risks and execution of risk measures periodically.

From among these significant risk events, we selected the “Groupwide risks” shown in the table below, which have a significant impact on the Group growth strategies and, by their nature, should be addressed across the Group from the perspectives of commonality, the degree of emergence, and efficiency.Risk details Impact Probability of occurrence Risks related to food quality labeling and sanitation High Low Risks related to blowing up on social media or crisis management public relations Medium Medium Risks related to earthquakes, tsunami, and volcanic eruptions High Low Risks related to cybersecurity Medium Low Risks related to response to antisocial forces Low Low The Significant risk events that the Company takes a leading role in managing(including Groupwide risks) are as follows.

(1) Group management risk

Risk details Risk class Risks related to Group management strategy and growth strategy Company monitored risk Anticipated Risk scenarios Based on the Group Strategy Reevaluation announced in March 2023, the Ideal Group Image for 2030 has been established as “A world-class retail group centered around its ‘food’ that leads retail innovation through global growth strategies centered on the 7-Eleven business and proactive utilization of technology.” During the course of executing measures aimed at achieving these goals, there is the possibility of such events as inappropriate allocation of management resources, impairment of the strengths in “food” assumed by the Company, and stagnation of the growth strategy for our domestic and overseas convenience store operations, which could affect the performance and financial standing of the Group. Measures ・Stabilize group management and strengthen monitoring functions through ongoing changes to group governance structures

・Monitor the progress of the Group’s key strategies on the Board of Directors, a majority of the members of which are independent outside directors

・Guarantee effectiveness of discussions of management's strategy and monitoring of progress by separating the roles of CEO and Chairman of the Board of DirectorsRisk details Risk class Risks related to the failure of M&A, sale or business alliance (recovery of investment) Company monitored risk Anticipated Risk scenarios The Group engages in strategic investments such as M&A in order to expand the business. Due to insufficient due diligence at the time of the acquisition, or for other reasons, PMI (Post Merger Integration) may not proceed smoothly, or the expected synergies may not be realized, which could lead to impairment losses. These factors could also result in a reduction in corporate value and affect the performance and financial standing of the Group. Measures ・Implement due diligence thoroughly at the time of acquisition

・Periodic monitoring of the integration processRisk details Risk class Risks related to M&A (takeover defense) Company monitored risk Anticipated Risk scenarios If a takeover bid against the Company that would damage our corporate value succeeds, changes in the strategic direction and corporate culture under the control of new shareholders and a new management team, and changes in the management team and senior managers, could lead to anxiety and dissatisfaction among employees, putting a huge burden on the integration of business processes and IT systems and causing a variety of problems. These factors could also result in a reduction in corporate value and affect the performance and financial standing of the Group. Measures ・Maximize corporate value of the Group through such measures as enhancing performance further and strengthening corporate governance

・Formulation of “The basic policy on the composition of persons to control the decision-making over the financial and business policies of the Company” and “Policy for dealing with takeover”

(2) Business risk

Risk details Risk class Risks related to the business model Company monitored risk Anticipated Risk scenarios The Group not only conducts its main businesses in Japan and the United States, but also operates in other regions around the world. In order to strengthen product development and product lineups to take regional characteristics into account and to respond accurately to customer needs, the Group undertakes joint development of products with business partners in a range of fields, in accordance with its sales strategy, and uses the apps of each company to make effective use of sales promotions by collecting and analyzing a variety of data. However, in the event that the economic situation in Japan, the United States, or in other countries and regions in which the Group operates deteriorates due to business conditions or trends in consumer spending or due to an inability to provide products and services that meet the needs of customers and markets, the performance and financial standing of the Group could be affected. Measures ・Monitor the state of business at operating companies using the Board of Directors, a majority of the members of which are independent outside directors

・Strengthens synergies and collaborative structures associated with “food”

・Revise price strategy based on surveys of markets and custom needs(3) Disclosure and brand risk

Risk details Risk class Risks related to blowing up on social media or crisis management public relations Groupwide risk Anticipated Risk scenarios Inappropriate behavior by customers or employees, or the posting of undisclosed information on social media may lead to a wave of criticism, which if taken up and distributed by mass media could result in damage to the corporate image of the Group. Delays or failures in the disclosure of appropriate information could have a significant impact on the business operations of the Group. Measures ・Provide training on social media to employees and strengthen their sense of crisis regarding its use (e-learning, regular dissemination of information on risks associated with social media)

・Hold risk measure training for risk management personnel, public relations personnel, social media operations personnel, etc.

・Establish a structure for the gathering, early detection, analysis, investigation, and assessment of information on social media and mass media, with the assistance of external specialist companies

・Prepare and distribute a crisis management public relations manual

・Strengthen the Company and Group company cooperative structures (information sharing, first response)Risk details Risk class Risks related to corporate brand management Company monitored risk Anticipated Risk scenarios Brand image could be damaged by PR or marketing strategies that are not congruent with corporate philosophy or by inappropriate communication by an official account. Blowing up on social media and coverage by various mass media could result in criticism from customers and business partners and significantly affect the business operations of the Group. Measures ・Put in place preventive measures such as establishing operational guidelines for social media use, screening documents through the use of a checking department, and verifying business appropriateness based on the compliance program

・Hold seminars to teach examples of blowing up on social media and measures, and provide training on information dissemination risks(4) Personnel and labor risk

Risk details Risk class Risks related to violations of labor laws and regulations and the health and safety of employees Company monitored risk Anticipated Risk scenarios In accordance with the standards of behavior set out in the Seven & i Holdings Corporate Action Guidelines, the Group has devised measures for occupational safety and health and for the prevention of occupational accidents, as well as introducing and supporting mechanisms to enable employees to work healthily. Nevertheless, in the event that deficiencies in the employment management of employees lead to a violation of the Labor Standards Act (unpaid overtime allowance, annual pay leave not being taken, etc.) and subsequently to administrative punishment (business suspension, fines, etc.), or in the event of damage to mental or physical health due to injury, illness, or overwork as a result of inadequate occupational health and safety measures, this could lead to a loss of appropriateness and efficiency in business operations and affect the performance and financial standing of the Group. Measures ・Manage working hours (overtime) and the taking of leave through the use of a working hours management system

・Have workplaces inspected by industrial physicians

・Disseminate information through the Health and Safety Committee

・Conduct stress checks for employees(5) Financial and accounting risk

Risk details Risk class Risks related to fluctuations in interest rates and exchange rates Company monitored risk Anticipated Risk scenarios The Group engages in derivatives transactions, such as those involving forward foreign exchange contracts and swaps, to optimize future cash flows, mitigate the risk of volatility in foreign exchange rates and interest rates, and reduce financing costs. However, fluctuations in interest rates have an impact on interest receipts and payments and on the value of financial assets and liabilities, and could affect the performance and financial standing of the Group.

Assets and liabilities of overseas group companies denominated in local currencies are converted to Japanese yen for the preparation of consolidated financial statements. Some of the products sold by the Group are products developed overseas that are affected by changes in foreign exchange rates, and so such fluctuations could affect the performance and financial standing of the Group.Measures ・Use forward foreign exchange contracts, swaps, and other derivatives transactions

・Monitor continuouslyRisk details Risk class Risks related to impairment of non-current assets Company monitored risk Anticipated Risk scenarios The ratio of property, plant and equipment and goodwill, etc. to consolidated total assets is high, and revenue management is implemented rigorously for stores, etc. However, in the event that becomes necessary to record impairment losses going forward due to deterioration in the profitability of stores, and significant declines in the market value of assets owned, the performance and financial standing of the Group could be affected. Measures ・Establish screening criteria for opening stores and monitor periodically

・Establish criteria for purchasing assets and monitor market value for assets held periodically(6) Legal and compliance risk

Risk details Risk class Risks related to competition law (violations of the Subcontractors Act or of regulations on abuse of dominant bargaining position) Company monitored risk Anticipated Risk scenarios The Group conducts business in Japan, the United States, and other countries around the world in compliance with the laws and regulations of each country and region with respect to fair competition. We monitor the status of compliance with these laws and regulations and have put in place structures to enable us to respond appropriately as required. However, in the event of violations of the Subcontractors Act or of regulations on abuse of dominant bargaining position as a result of reducing fees, delaying payments, demanding the dispatch of temporary employees, or other inappropriate behavior, the Group may be subject to measures taken by an administrative agency involved in matters of fair trade, such as guidance, recommendations, public announcements, cease and desist orders, surcharge payment orders, or criminal penalties. Consequently, the business activities, performance, and financial standing of the Group could be affected. Measures ・Implement voluntary inspections, monitoring programs, and questionnaires of business partners, and establish Business Partner Helpline

・Provide internal education through e-learning and training on fair trade (to ensure compliance with trading rules and raise awareness among employees)Risk details Risk class Risks related to intellectual property rights Company monitored risk Anticipated Risk scenarios Products and services of the Group could infringe intellectual property rights held by third parties, leading to disputes, etc., and resulting in reductions in revenue caused by injunctions to prevent usage, liability for damages, and other outcomes. On the other hand, violations of intellectual property rights of the Company through the imitation by third parties of designs and technology pertaining to the products and services of the Group could lead to a reduction in competitiveness and the impairment of our brand image. These could affect the performance and financial standing of the Group. Measures ・Establish a system for researching the intellectual property rights of third parties when providing new products and services

・Implement “patrols” of the intellectual property rights of the Company (activities to look out for infringements)

・Provide intellectual property education (e-learning, study group sessions, etc.)Risk details Risk class Risks related to response to antisocial forces Groupwide risk Anticipated Risk scenarios Based on the Seven & i Holdings Corporate Action Guidelines, the Group has set a policy of not engaging with antisocial forces, but in the event that it becomes clear that dealings with antisocial forces have taken place, the consequences could include sanctions such as public announcements and punishments based on relevant laws and regulations, dispositions by administrative agencies, suspension of dealings with financial institutions, cancellation of agreements with trusted business partners, and so on. In addition, mistakes in the approach used to address the issue could result in the matter being taken up by social media and mass media, leading to impairment of the corporate image of the Group. These could affect the performance and financial standing of the Group. Measures ・Build system for group-wide checks for antisocial forces and monitor periodically

・Prepare a manual on how to respond when dealings with antisocial forces come to light

・Information exchange with external police-affiliated organizations(7) Information security and system risk

Risk details Risk class Risks related to cybersecurity Groupwide risk Anticipated Risk scenarios In order to provide customers with new value and services in each of its businesses, centered on retail, the Group handles data entrusted by customers, confidential commercial information, and other important information. In order to protect such information, the Group has designated cyberattacks a serious risk to the business and is striving to strengthen its cybersecurity measures. However, methods of attack are becoming more diverse and sophisticated with every passing day, and include attacks such as targeted threat email and ransomware on specific targets, DDoS and other attacks that put a burden on the system, and attacks that target vulnerabilities in teleworking and online meeting systems. In the event of an external cyberattack resulting in such damage as leaks of important information, alteration or loss of data, takeovers of customer accounts, or interruptions of systems and services, this could have a tremendous impact on our reputation among consumers and in society. Measures ・Use 7&i CSIRT (7&i Computer Security Incident Response Team) to provide rapid responses and promote prevention measures and countermeasures

・Use SOC (Security Operation Center) to detect security risks and analyze and respond to threat information

・Collaborate on information security with specialist external organizations

・Implement security reviews and diagnostics for information security measures and vulnerabilities

・Provide cybersecurity education and training for incident response personnel at Group companies

・Provide periodic training on targeted threat email for all employees

・Implement job-specific (directors, managers, general employees) information security education programRisk details Risk class Risks related to systems Company monitored risk Anticipated Risk scenarios The Group operates a large number of IT systems to enable it to perform its business activities. Given the requirement for stable operation of these systems, the Group has designated risks related to information systems a serious risk to the business and is striving to strengthen measures. However, insufficient quality management during development, deficiencies in system settings, human errors in operation, unexpected suspensions of external services including cloud services, and natural disasters such as major earthquakes or windstorm, flood, or other phenomena could result in damage to information systems and hinder stable operation, which could cause damage to assets, interrupt business operations and services, and have a tremendous impact on our reputation among consumers and in society. Measures ・Implement thorough reviews at each stage of the development process, beginning with IT service planning

・Strengthen management of system development schedules and resource management

・Secure human resources with knowledge and skills for new development techniques

・Monitor for deficiencies in system settings and deploy software for security measures

・Selection and evaluation of cloud services

・Build redundancy into core information systems such as servers and networks

・Strengthen fault monitoring of hardware and networks, etc.

・Enhance protective measures for important facilities and equipmentRisk details Risk class Risks related to personal information Company monitored risk Anticipated Risk scenarios In order to provide customers with new value and services in each of its businesses, centered on retail, the Group handles personal information from customers, suppliers, and other parties. In response to the rising importance of personal information, which requires it to be handled in compliance with laws and regulations, the Group has designated risks related to personal information a serious risk to the business and is striving to strengthen measures. However, insufficient enhancement of internal controls in response to changes in internal and external environments, insufficient safety measures, human error in the handling of personal information, illicit behavior by employees, deficiencies in the management of subcontractors, etc. could lead to leakage, destruction, or impairment of personal information, resulting in violations of laws and regulations, which could cause damage to assets, interrupt business operations and services, and have a tremendous impact on our reputation among consumers and in society. Measures ・Maintain and revise “Group Personal Information Protection Policy”

・Maintain procedures that are compliant with laws and regulations, including the Act on the Protection of Personal Information

・Maintain safety measures that are compliant with ISO27001 and other standards

・Implement education and training for employees

・Strengthen management of subcontractors

・Establish emergency countermeasures in the event of an accident involving personal information(8) Quality risk

Risk details Risk class Risks related to food quality labeling and sanitation Groupwide risk Anticipated Risk scenarios In accordance with relevant laws and regulations, the Group strives to provide safe and secure products to customers and to communicate information accurately. The Group is also taking on the challenge of expanding “Seven Premium” as well as original products from Group companies in order to continue to provide new value and high-quality products and services to customers. Nevertheless, in the event of a serious incident occurring as a result of violations of the Food Labeling Act, deficiencies in food sanitation management, or other events, the performance and financial standing of the Group could be affected by such factors as a loss of trust in the Group’s products, payment of compensation to customers, and product recall and other remedial costs. Measures ・Implement joint initiatives with business partners to improve quality management, and put in place measures to prevent labeling errors, deficiencies in sanitation management, and other serious incidents.

・Promote training to prevent labeling errors and deficiencies in sanitation management in stores, and promote the introduction of countermeasure facilities

・Provide education and training for employees, such as HACCP training, supplier audit training, and various types of e-learning

・Implement internal and external audit of production facilities for Seven Premium products(9) Supply chain risk

Risk details Risk class Risks related to the hindrance of stable supply (operational factors) Company monitored risk Anticipated Risk scenarios For the business activities of the Group, it is essential that we are able to purchase products and raw materials, etc. of adequate quality, in sufficient quantity and at the required time, and we seek to diversify procurement so that we are not overly dependent on specific regions, suppliers, products, technologies, or other factors. In particular, there is a possibility that rising temperatures, changes in precipitation and weather patterns, and other forms of climate change will lead to reductions in the yield and quality of agricultural, livestock and marine products, as well as changes in fishing grounds and regions suitable for the cultivation of agricultural products. In response to such potential changes we are making efforts to diversify procurement and to work with primary producers to improve yields, but in the event that rising temperatures, changes in weather patterns, and other forms of climate change may lead to the suspension of factory production and to the subsequent interruption of some procurement routes. Supply chains could also be interrupted by soaring prices for fuel used by operators of delivery services and human capital shortages in the logistics industry. In future, purchasing prices could also be affected by soaring prices for energy, including electricity, at the product manufacturing stage, caused by such factors as regulations arising from climate change, policies, and conflicts. These could affect the performance and financial standing of the Group. Measures ・Secure substitute sources of energy and facilities, prepare manuals for response in times of emergency, and implement training

・Monitor market trends, revise prices, and develop high-markup products, procure raw materials at a fixed cost, etc.

・Monitor credit information and cash flows at business partners, diversify risk to avoid dependence on specific suppliers

・Stabilize deliveries by improving logistics cost efficiencies and through cooperation with operators of delivery services(10) Disaster, accident and incident risk

Risk details Risk class Risks related to earthquakes, tsunami, and volcanic eruptions Groupwide risk Anticipated Risk scenarios The Group not only conducts business in Japan and the United States but also in other regions around the world. Moreover, the core business of the Group is retail, which acts as a lifeline to local communities, and in the event of a major earthquake, especially one that occurs in a metropolitan area in which the stores that constitute our core business are concentrated, our supply chains could be interrupted and our business activities suspended, leading to massive costs being incurred for the restoration of facilities, and creating enormous obstacles to the business operations of the Group, the performance and financial standing of the Group could be affected. Furthermore, in the event that the process of restoring business activities is prolonged, the Group may be unable to fulfill its role as a provider of social infrastructure, such as engaging in aid activities in regions in the aftermath of the disaster. Measures ・Establish and update Business Continuity Plan (BCP) for responding to a major disaster and establish systems to enable us to put human life first in accordance with the BCP

・Build system of Business Continuity Management (BCM) for the Group as a whole, centered on training

・Provide education to employees (disaster prevention e-learning and training, etc.)

・Implement countermeasures exercises simulating a major natural disaster (including cooperation between Group companies)Risk details Risk class Risks related to floods, typhoons, torrential rain, tornadoes, lightning or heavy snowfall Company monitored risk Anticipated Risk scenarios In the event of river flooding, etc. as a result of typhoons or other strong winds and torrential rain, our supply chains could be interrupted and our business activities suspended, leading to massive costs being incurred for the restoration of facilities, and creating enormous obstacles to the business operations of the Group, the performance and financial standing of the Group could be affected. Furthermore, in the event that the process of restoring business activities is prolonged, the Group may be unable to fulfill its role as a provider of social infrastructure, such as engaging in aid activities in regions in the aftermath of the disaster. Measures ・Gather information and hold meetings to discuss measures in advance

・Disseminate plans for responding to a major disaster (BCP) and establish systems to enable us to put human life first in accordance with the BCP

・Implement water countermeasures (flood barriers, installation of watertight panels), and implement disaster prevention education and training

・Established alternative locations and establish backup structures for logistics centers(11) Human rights risk

Risk details Risk class Risks related to violations of human rights (employees, business partners) Company monitored risk Anticipated Risk scenarios With the increasing globalization of corporate activities, there is growing social interest in the human rights efforts of companies. In October 2021, we established the Seven & i Holdings Human Rights Policy based on the International Bill of Human Rights (Universal Declaration of Human Rights and International Covenants on Human Rights), the ILO Declaration on Fundamental Principles and Rights at Work, and the UN Guiding Principles on Business and Human Rights, and we are striving to prevent and mitigate negative impacts on human rights by establishing a human rights due diligence mechanism. With the cooperation of our business partners, we are also moving forward with initiatives to respect human rights based on the Seven & i Holdings Business Partner Sustainable Action Guidelines. However, any deviation from these policies could lead to a decline in trust in the Group among customers and business partners, which may adversely affect the performance and financial standing of the Group. Measures ・Provide education and training to employees (harassment prevention training, e-learning, etc.) and awareness-raising activities for business partners

・Implement culture & engagement surveys, questionnaire surveys for business partners, and CSR audits of factories at which the Group’s original products are manufactured

・Promote use of whistleblowing system (Seven & i Holdings Employee Helpline, Business Partner Helpline, Audit & Supervisory Board Hotline) to enable early detection of and corrective action for human rights violations, etc.(12) Environmental risk

Risk details Risk class Risks related to climate change and natural capital (physical risks) Company monitored risk Anticipated Risk scenarios A range of environmental problems have begun to emerge, including global climate change and the issue of plastic pollution. To address such changes in society, the Group has drawn up the “GREEN CHALLENGE 2050” environmental declaration, in which it designates decarbonization, a circular economy, and a society in harmony with nature as its vision for society, and is proceeding with initiatives to accomplish these goals. However, increases in the frequency of occurrence and severity of natural disasters resulting from climate change could cause damage to stores and the distribution network, and lead to a rise in associated costs of store operation. Increases in the frequency of occurrence and severity of natural disasters, and changes in weather patterns could also make procurement of raw material difficult. Moreover, because as a food-focused retail group we are highly dependent on nature for the production of raw materials and particularly agricultural produce, decreases in the production of and soaring prices for raw materials driven by deterioration in natural capital, damage to biodiversity, and other factors could make it difficult for the Company to source raw materials and products, which may adversely affect the performance and financial standing of the Group. Measures [Response to general climate change and natural capital risks]

・Formulation of GREEN CHALLENGE 2050 environmental declaration (2019)

・Formation of innovation teams based on these four themes of GREEN CHALLENGE 2050

[Response to climate change]

・Scenario analysis and information disclosure based on TCFD recommendations

・Evolution of scenarios based on social changes

・Consideration and implementation of substantive measures to address risks and opportunities in the supply chain as a whole

[Response to natural capital]

・Formulation of natural capital policy (October 2024)

・Information disclosure in accordance with TNFD recommendations (first disclosure in September 2024)

・Assessment of businesses and their dependencies and impacts on nature, assessment of risks and opportunities in coffee beans, and consideration of countermeasures

・Expand scope of raw material subject to analysisRisk details Risk class Risks related to response to environmental regulations and laws (transition risks) Company monitored risk Anticipated Risk scenarios A range of environmental problems have begun to emerge, including global climate change and the issue of plastic pollution. To address such changes in society, the Group has drawn up the “GREEN CHALLENGE 2050” environmental declaration, in which it designates decarbonization, a circular economy, and a society in harmony with nature as its vision for society, and is proceeding with initiatives to accomplish these goals. Conversely, the Group is subject to the application of a variety of environmental laws and regulations dealing with climate change measures, including reductions in energy usage and CO2 emissions, food waste, recycling of containers and packaging made out of plastic and other materials, and treatment of waste. In the future, it is possible that laws and regulations will be strengthened, for example, heightened interest in natural capital and biodiversity could lead to the introduction of regulations associated with procurement of raw materials, or regulations controlling greenhouse gas emissions may be bolstered as a climate change measure, or new laws and regulations and policies, such as carbon taxes, may be introduced. For the Group, compliance with laws and regulations could lead to additional costs and constraints on its business activities. In addition, fluctuations in the cost of energy such as gas and electricity resulting from strengthened regulations could increase expenses associated with store operation, and affect the performance and financial standing of the Group. Measures [Response to general environmental regulation/legislation risks]

We are moving forward with initiatives led by innovation teams based on the following four themes of all GREEN CHALLENGE 2050

・Reduction of CO2 emissions

- Establish a retail electric operating company to promote the use of renewable energy

- Encourage the adoption of energy-saving and energy-generation facilities in stores

- Long-term procurement of electricity derived exclusively from power plants using renewable energy such as solar and wind (offsite PPA, etc.)

・Measures against plastic

- Reduce use of plastic materials, replace them with environmentally friendly materials, establish goals and plans to promote recovery and recycling

・Measures against food loss/ waste and for organic waste recycling

- Place the highest priority on curbing the generation of food waste in stores, and promote initiatives for food waste that has been generated with an awareness of the circular economy

・Sustainable procurement

- Promote procurement of products that are guaranteed to be sustainable, in accordance with the Seven & i Holdings Sourcing Principles and Policies