- Top

- Investor Relations

- Management Policy

- Corporate Governance

- Composition, etc., of the Board of Directors

Composition, etc., of the Board of Directors

Last update: November 4, 2025

1. Composition of the Board of Directors (balance among knowledge, experience, and skills, and diversity and size, of the Board of Directors) and reasons for selection as director [CGC Principle 3.1 (v)][CGC Supplementary Principle 4.11.1, 2]

The Company emphasizes the composition of directors and Audit & Supervisory Board members

for the Board of Directors having a good overall balance of knowledge, experience, and skills to effectively

perform the role and responsibilities of the Board and ensuring both diversity and an appropriate

size.

In particular, as a holding company, the Company needs to conduct comprehensive and

multifaceted management for diverse business domains. Therefore, the Company examines the Board composition,

considering diversity (including career and age) in terms of female and non-Japanese Directors and Audit &

Supervisory Board Members as well as the balance among their knowledge, experience, and skills. For the

Company's Audit & Supervisory Board Members, the Company takes care to appoint such persons with

appropriate knowledge of finance and accounting.

The Company stipulates the aforementioned

policies in the "Guidelines for Directors and Audit & Supervisory Board Members" (See "

Guidelines for Directors and Audit & Supervisory Board Members

").

Composition, etc., of the Board of Directors for FY2025

The Company executed a bold reform to a Board of Directors composed with Independent Outside

Directors in the majority at its FY2022 Shareholder’s Meeting to establish a governance structure suitable

for a world-class retail group as it is aiming for in its Medium-term Management Plan 2021-2025 announced

in July 2021.

Continuing from FY2024, the composition of the Board of Directors in FY2025 emphasizes experience in top management at listed companies; knowledge and experience relating to food, digital transformation (DX), and global management, which are viewed as the strategic axes of the Group; and skill sets such as specialization in business transformation to establish a management structure which will contribute to further growth and maximization of long-term corporate value and shareholder value. This skill set was created following deliberation by the Nomination Committee and the Board of Directors.

The

Board of Directors of the Company will make important decisions which support the swift and decisive

risk-taking of the management team with its diverse members as described above. At the same time, it will

provide highly-effective oversight and appropriately fulfill its roles and responsibilities as the Board

of Directors.

Chairperson of the Board of Directors

The Board of Directors resolved at its meeting on April 18, 2024 that the Company will separate the positions of chairperson of the Board of Directors and chief executive officer (CEO) for the purposes outlined below.

Purposes

- (1) Strengthen corporate governance system

- (2) Improve transparency and objectivity in decision-making

- (3) Improve effectiveness of corporate strategies and efficiency of corporate operations

Based on this policy, Fuminao Hachiuma assumed the position of chairperson of the Board of Directors at its meeting held on May 27, 2025.

Establishment of Lead Independent Outside Director

Because a majority of the members of the Board of Directors are outside directors with diverse experience and skills, the Company established the position of lead independent outside director to enhance the effectiveness of the Board’s oversight function by fulfilling the following roles.

Roles of the lead independent outside director

- (1) Ensure mutual coordination and follow-up among Outside Directors.

- (2) Further enhance and maintain dialogue and communication between Outside Directors and senior management.

- (3) Strengthen coordination between Outside Directors and the Audit & Supervisory Board.

- (4) Promote “constructive dialogue with shareholders and investors” in which Outside Directors participate.

Appointment of Audit & Supervisory Board Members with expertise with regard to finance and accounting

The Company has appointed the following four Audit & Supervisory Board Members who have expertise with regard to finance and accounting.

- Standing Audit & Supervisory Board Member Shinya Ishii was engaged in operations relating to corporate management for a total of more than 29 years in the corporate management department of the Company and its Group.

- Standing Audit & Supervisory Board Member Nobutomo Teshima was engaged in operations relating to finance and accounting in the finance and accounting department of the Company and its Group for a total period of 25 years or more.

- Audit & Supervisory Board Member Kazuhiro Hara is a certified public accountant and certified tax accountant.

- Audit & Supervisory Board Member Kaori Matsuhashi is a certified public accountant.

Major management and industry experience, management skills, knowledge, etc. of

Directors and Audit & Supervisory Board Members

| Name | Title | Corporate-Management | Retail Industry | Global Business | Marketing/Branding | DX/IT/ Security | Finance,Accounting, Capital markets | Risk Management /Compliance |

Sustainability |

|---|---|---|---|---|---|---|---|---|---|

| Junro Ito | Representative Director and Chairperson (Kaicho) | ◯ | ◯ | ◯ | ◯ | ||||

| Stephen Hayes Dacus | Representative Director and President | ◯ | ◯ | ◯ | ◯ | ◯ | |||

| Shigeki Kimura | Representative Director and Vice President | ◯ | ◯ | ◯ | ◯ | ◯ | |||

| Yoshimichi Maruyama | Director | ◯ | ◯ | ◯ | |||||

| Tamaki Wakita | Director | ◯ | ◯ | ◯ | ◯ | ||||

| Fuminao Hachiuma | Lead Independent Outside Director | ◯ | ◯ | ◯ | ◯ | ||||

| Yoshiyuki Izawa | Independent Outside Director | ◯ | ◯ | ◯ | ◯ | ||||

| Meyumi Yamada | Independent Outside Director | ◯ | ◯ | ◯ | ◯ | ◯ | |||

| Paul Yonamine | Independent Outside Director | ◯ | ◯ | ◯ | ◯ | ||||

| Takashi Sawada | Independent Outside Director | ◯ | ◯ | ◯ | ◯ | ◯ | |||

| Masaki Akita | Independent Outside Director | ◯ | ◯ | ◯ | ◯ | ◯ | |||

| Tatsuya Terazawa | Independent Outside Director | ◯ | ◯ | ◯ | ◯ | ||||

| Christine Edman | Independent Outside Director | ◯ | ◯ | ◯ | ◯ | ◯ | |||

| Shinya Ishii | Standing Audit & Supervisory Board Member | ◯ | ◯ | ◯ | |||||

| Nobutomo Teshima | Standing Audit & Supervisory Board Member | ◯ | ◯ | ◯ | ◯ | ||||

| Kazuhiro Hara | Independent Outside Audit & Supervisory Board Member | ◯ | ◯ | ◯ | ◯ | ||||

| Mitsuko Inamasu | Independent Outside Audit & Supervisory Board Member | ◯ | ◯ | ||||||

| Kaori Matsuhashi | Independent Outside Audit & Supervisory Board Member | ◯ | ◯ | ◯ | ◯ | ◯ | ◯ |

* The above table is not an exhaustive list of the knowledge and experience each person can offer.

* The ratio of foreign national Directors will be 23.1% (3/13) and the ratio of female Directors will be 15.4% (2/13). (Rounded to one decimal place)

Director (Internal) Updated

| Name (date of birth) |

(June 14, 1958) Brief personal history  Representative Director & Executive Chair

Junro Ito

(June 14, 1958)

|

(November 7, 1960) Brief personal history  Representative Direcetor & President

Stephen Hayes Dacus

(November 7, 1960)

|

(March 16, 1962)Brief personal history  Representative Director & Vice President

Shigeki Kimura

(March 16, 1962)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reasons for Selection (experience and knowledge) |

He has overseas business experience and a broad range of knowledge of the retail industry cultivated as Vice President and a director of the Company and its Group companies as well as a broad range of knowledge and experience in company management, social marketing, risk management, sustainability, and so forth. The Company would like him to utilize this knowledge and experience to realize our management plans, to enhance our corporate value including non-financial aspects, and to smoothly execute group management. | He has served as a corporate executive officer in the retail industry and other industries both in the U.S. and Japan, and has a broad range of high level knowledge and experience in marketing and finance and accounting, etc. cultivated through abundant global business experience. He was appointed as an Independent Outside Director of the Company in May 2022, and was appointed as the Chairman of the Board of Directors and Lead Independent Outside Director in April 2024. As Chair of the Strategic Committee and the Special Committee, he has played an important role in overseeing strategies for the pursuit of Group value creation. The Company would like him to utilize this knowledge and experience to realize our management plans, and to refine our management system, capital structure, and business operations with a focus on the convenience store business in order to maximize the Group’s corporate value. | He has a broad range of knowledge of the retail industry cultivated as a Director of the Company and Vice President of a Group company, as well as a broad range of knowledge and experience in company management including the franchise business, risk management, IT, sustainability, and other areas. The Company would like him to utilize this knowledge and experience to realize our management plans, to enhance Group functions, and to pursue Group synergies. |

| Name (date of birth) |

(November 2, 1959) Brief personal history  Director & Managing Executive Officer

Yoshimichi Maruyama

(November 2, 1959)

|

(May 12, 1972) Brief personal history  Director & Managing Executive Officer

Tamaki Wakita

(May 12, 1972)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reasons for Selection (experience and knowledge) |

He has business experience in a financial institution and a broad range of knowledge relating to the Group’s overall operations cultivated as a senior officer in the risk management division of the Company and the finance division of the Company as well as a broad range of knowledge and experience relating to risk management, finance and accounting, and so forth. The Company would like him to utilize this knowledge and experience to realize our management plans, to stabilize the Group’s financial base, and to strengthen financial discipline. | He has overseas business experience and a broad range of knowledge of the retail industry, cultivated as a president and director of the Group companies, as well as a broad range of knowledge of and experience in company management, marketing, and so forth. The Company would like him to utilize this knowledge and experience to realize our management plans, to promote the management of the Group, and to formulate our future management strategy. |

Director (Outside)Updated

| Name (date of birth) |

(December 8, 1959) Brief personal history  Director

Fuminao Hachiuma

(December 8, 1959)

|

(February 10, 1948) Brief personal history  Director

Yoshiyuki Izawa

(February 10, 1948)

|

(August 30, 1972) Brief personal history  Director

Meyumi Yamada

(August 30, 1972)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reasons for Selection (experience and knowledge) |

He has a broad range of high level knowledge and experience in corporate management, marketing and sustainability, among others as well as abundant international knowledge related to “Food” cultivated through his experience serving in important positions such as Representative Director at food companies in Japan and overseas. The Company would like him to utilize this knowledge and experience to realize our management plans and to further improve the effectiveness of our management and the Board of Directors. | He has a broad range of high level knowledge in international corporate management, finance and accounting, capital markets, sustainability, among others, and as well as his experience served as a Representative Director of a trading company and a financial institution, and has served such important positions as Chairman & CEO, Representative Director of BlackRock Japan Co., Ltd. The Company would like him to utilize this knowledge and experience to realize our management plans and to further improve the effectiveness of our management and the Board of Directors. | She has a broad range of high level knowledge and experience in corporate management, EC (e-commerce), DX (digital transformation), marketing, sustainability, among others, which she has cultivated through the operation of “@cosme,” one of Japan’s largest cosmetics and beauty portal sites, and through starting up a women’s skill development and job hunting support business. The Company would like her to utilize this knowledge and experience to realize our management plans and to further improve the effectiveness of our management and the Board of Directors. |

| Name (date of birth) |

(August 20, 1957) Brief personal history  Director

Paul Yonamine

(August 20, 1957)

|

(July 12, 1957) Brief personal history  Director

Takashi Sawada

(July 12, 1957)

|

(December 24, 1958) Brief personal history  Director

Masaki Akita

(December 24, 1958)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reasons for Selection (experience and knowledge) |

He has a broad range of high level knowledge and experience in DX (digital transformation), finance, and accounting, etc. cultivated through his extensive management experience at consulting firms, as President of IBM Japan, Ltd. and as CEO of overseas financial institutions, among others. The Company would like him to utilize this knowledge and experience to realize our management plans and to further improve the effectiveness of our management and the Board of Directors. | He has a broad range of high level knowledge and experience in overseas expansion in the retail industry, franchise businesses, branding, and finance and accounting, etc., cultivated through his extensive track record in corporate management as Vice President of FAST RETAILING CO., LTD. and in other roles. The Company would like him to utilize this knowledge and experience to realize our management plans and to further improve the effectiveness of our management and the Board of Directors. | He has wide-ranging knowledge of the inbound tourism business and of food, as well as a broad range of high level knowledge and experience in marketing, risk management, etc., cultivated through his track record in corporate management as the Representative Director of Matsuya Co., Ltd. and in other roles. The Company would like him to utilize this knowledge and experience to realize our management plans and to further improve the effectiveness of our management and the Board of Directors. |

| Name (date of birth) |

(January 20, 1961) Brief personal history  Director

Tatsuya Terazawa

(January 20, 1961)

|

(December 23, 1975) Brief personal history  Director

Christine Edman

(December 23, 1975)

|

|||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reasons for Selection (experience and knowledge) |

He has served as Vice-Minister for International Affairs in the Ministry of Economy, Trade and Industry, and as Chairman and CEO of The Institute of Energy Economics, Japan, as well as in other important roles, and has a broad range of high level knowledge and experience in such areas as international trade, franchise businesses, risk management, and sustainability. The Company would like him to utilize this knowledge and experience to realize our management plans and to further improve the effectiveness of our management and the Board of Directors. | She has wide-ranging knowledge of the global retail industry, as well as a broad range of high level knowledge and experience in such areas as DX (digital transformation), marketing and branding, cultivated through her experience serving as the representative director of companies in the apparel industry both in Japan and overseas, and in other important roles. The Company would like her to utilize this knowledge and experience to realize our management plans and to further improve the effectiveness of our management and the Board of Directors. |

Audit & Supervisory Board Member (Internal/Outside)

| Name (date of birth) |

(February 21, 1965) Brief personal history  Standing Audit & Supervisory Board Member

Shinya Ishii

(February 21, 1965)

|

(June 15, 1962) Brief personal history  Standing Audit & Supervisory Board Member

Nobutomo Teshima

(June 15, 1962)

|

(February 25, 1954) Brief personal history  Audit & Supervisory Board Member

Kazuhiro Hara

(February 25, 1954)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reasons for Selection (experience and knowledge) |

He has wide-ranging knowledge of the operations of the Group as a whole, as well as a broad range of knowledge and experience in finance, accounting, and management administration, cultivated in his role of Executive Officer, Senior Officer of the Corporate Management Department. The Company would like him to contribute this knowledge and experience to the establishment of a good corporate governance structure that can realize robust and sustainable growth of the Company, create medium- to long- term corporate value, and respond to social trust. | He has extensive knowledge and experience in finance and accounting, risk management, and information technology, etc., as well as a broad range of knowledge of the Group’s overall operations, which he cultivated as a senior officer in the Accounting Management Department and Auditing Office. The Company would like him to contribute this knowledge and experience to the establishment of a good corporate governance structure that can realize robust and sustainable growth of the Company, create medium- to long- term corporate value, and respond to social trust. | He has abundant experience and technical knowledge related to finance, accounting, tax, and risk management cultivated as a certified public accountant and tax accountant. The Company would like him to contribute to the establishment of a good corporate governance structure that can realize the robust and sustainable growth of the Company, create medium- to long-term corporate value, and respond to social trust by utilizing his knowledge and experience. |

| Name (date of birth) |

(March 15, 1976) Brief personal history  Audit & Supervisory Board Member

Mitsuko Inamasu

(March 15, 1976)

|

(June 7, 1969) Brief personal history  Audit & Supervisory Board Member

Kaori Matsuhashi

(June 7, 1969)

|

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reasons for Selection (experience and knowledge) |

She has abundant experience and technical knowledge related to overall corporate legal affairs, including legal affairs pertaining to the digital field, and risk management cultivated as an attorney at law. The Company would like her to contribute to the establishment of a good corporate governance structure that can realize the robust and sustainable growth of the Company, create medium- to long-term corporate value, and respond to social trust by utilizing her knowledge and experience. | She has abundant experience and technical knowledge related to finance, accounting, business management, and risk management cultivated through her experience in a business company and as a consultant and certified public accountant. The Company would like her to contribute to the establishment of a good corporate governance structure that can realize the robust and sustainable growth of the Company, create medium- to long-term corporate value, and respond to social trust by utilizing her knowledge and experience. |

2. Numbers and composition ratios of Outside Directors and Outside Audit & Supervisory Board Members

As a holding company, the Company needs to conduct comprehensive and multifaceted management for

diverse business domains. Accordingly, the composition of its Outside Directors and Outside Audit &

Supervisory Board Members is to be examined considering not only ensuring diversity but also bearing in mind

the overall balance of knowledge, experience, and skills. The Company therefore values having a diverse team

of Outside Directors and Outside Audit & Supervisory Board Members to provide multifaceted management

advice, including raising issues, and thereby ensures active discussion within the Board of

Directors.

While being extremely conscious of the diversity of its Outside Directors and

Outside Audit & Supervisory Board Members, we believe that the most important aspect is "personnel

selection." We have not yet reached the conclusion that setting formal numbers of Outside Directors and

Outside Audit & Supervisory Board Members based on constant composition ratios would be optimal for the

Company's Board of Directors. Therefore, we have not set a specific policy on the composition ratio of Outside

Directors and Outside Audit & Supervisory Board Members, including Independent Outside

Directors.

We will continue to discuss this point, not only through dialogue with our

stakeholders, but also based on social trends.

3. View on independence of Outside Directors and Outside Audit & Supervisory Board Members and independence standards [CGC Principle 4.9]

(1) Designation of Independent Directors and Independent Audit & Supervisory Board Members

The Company designates all Outside Directors and Outside Audit & Supervisory Board Members who satisfy the qualifications for independent officers as the Independent Outside Directors and Independent Outside Audit & Supervisory Board Members.

(2) Independence standards for Outside Directors and Outside Audit & Supervisory Board Members

As mentioned above, the Company emphasizes diversity in its Directors and Audit & Supervisory Board Members, including in Outside Directors and Outside Audit & Supervisory Board Members, and strives to secure high-quality external human resources who will support enhanced corporate governance. Accordingly, the Company has adopted the following standards for independence of Outside Directors and Outside Audit & Supervisory Board Members, considering that it is better to judge each candidate from the essential perspective of whether they have any potential conflict ofinterest with general shareholders.

We will continue to appropriately review the standards from time to time, taking into account the status of domestic and overseas Corporate Governance Code and the actual situation of outside directors.

1. Independence standards for Outside Directors and Outside Audit & Supervisory Board Members

i) Fundamental approach

Independent Directors and Independent Audit & Supervisory

Board Members are defined as Outside Directors and Outside Audit & Supervisory Board Members who

have no potential conflicts of interest with general shareholders of the Company.

In

the event that an Outside Director or an Outside Audit & Supervisory Board Member is likely to be

significantly controlled by the management of the Company or is likely to significantly control the

management of the Company, that Outside Director or Outside Audit & Supervisory Board Member is

considered to have a potential conflict of interest with general shareholders of the Company and is

considered to lack independence.

ii) Independence standards

In accordance with this fundamental approach, the Company uses the independence standards established by the Tokyo Stock Exchange as the independence standards for the Company's Outside Directors and Outside Audit & Supervisory Board Members.

2. De minimis thresholds for information disclosure regarding the attributes of Independent Directors and Independent Audit & Supervisory Board Members as negligible

(In the most-recent business year of the Company)

- With regard to "transactions," "less than 1% of the non-consolidated revenues from operations of the Company in the most recent accounting period"

- With regard to "donations," "less than ¥10 million"

4. Support system for Outside Directors and Outside Audit & Supervisory Board Members

The Company has assigned dedicated employees to assist the Outside Directors and Outside Audit & Supervisory Board Members in their duties, enabling close coordination and smooth exchange of information with the internal Directors and internal Audit & Supervisory Board Members. The Company has also concluded liability limitation agreements with Outside Directors and Outside Audit & Supervisory Board Members to ensure they can perform their roles as expected. These agreements limit the amount of their liability for compensation for damage to the minimum legally stipulated amounts.

5. Main activities of Outside Directors and Outside Audit & Supervisory Board Members

(1) Attendance at Board of Directors, etc. and main comments made during the 20th Fiscal Year (from March 1, 2024 to February 28, 2025)

| Outside Director |

|

|

|

|

|

|---|---|---|---|---|---|

| Attendance at Board of Directors and Committee meetings during the 20th fiscal year | Board of Directors 16/16 Nomination Committee 10/10 Compensation Committee - |

Board of Directors 16/16 Nomination Committee 10/10 Compensation Committee - |

Board of Directors 16/16 Nomination Committee 10/10 Compensation Committee - |

Board of Directors 16/16 Nomination Committee 10/10 Compensation Committee - |

Board of Directors 15/16 Nomination Committee - Compensation Committee 8/8 |

| Summary of main comments made by outside directors and duties performed in relation to expected roles | Opinions based on his broad high level knowledge and experience regarding organizational management, marketing, and finance and accounting, etc. | Opinions based on his broad high level knowledge and experience in international corporate management, finance and accounting, capital markets, sustainability, etc. | Opinions based on her broad high level knowledge and experience in corporate management, EC (e-commerce), DX (digital transformation), marketing, sustainability, etc. | Opinions based on his broad high level knowledge and experience in corporate management, marketing and sustainability, etc. | Opinions based on his broad high level knowledge and experience in DX (digital transformation), finance, and accounting, etc. |

| Outside Director |

|

|

|

|

|

|---|---|---|---|---|---|

| Attendance at Board of Directors and Committee meetings during the 20th fiscal year | Board of Directors 16/16 Nomination Committee 4/4 Compensation Committee 7/8 |

Board of Directors 12/13 Nomination Committee - Compensation Committee - |

Board of Directors 16/16 Nomination Committee - Compensation Committee 8/8 |

Board of Directors 16/16 Nomination Committee - Compensation Committee - |

|

| Summary of main comments made by outside directors and duties performed in relation to expected roles | Opinions based on his broad high level knowledge and experience regarding organizational management, risk management, etc. | Shares opinions based on a wide range of advanced knowledge and experience relating to company management in the retail industry, DX, organizational management, and corporate governance, among other matters | Opinions based on her broad high level knowledge and experience regarding global legal affairs and risk management, finance and accounting, and sustainability, etc. | Opinions based on her broad high level knowledge and experience regarding digital transformation (DX), marketing, and finance and accounting, etc. |

| Outside Audit & Supervisory Board Member |

|

|

|

||

|---|---|---|---|---|---|

| Attendance at Board of Directors and Audit & Supervisory Board during the 20th fiscal year | Board of Directors 16/16 Audit & Supervisory Board 26/26 |

Board of Directors 16/16 Audit & Supervisory Board 26/26 |

Board of Directors 15/16 Audit & Supervisory Board 26/26 |

||

| Main comments | Questions and opinions based on his abundant experience and technical knowledge related to finance, accounting, tax and risk management | Questions and opinions based on her abundant experience and technical knowledge related to overall corporate legal affairs and risk management | Questions and opinions based on her abundant experience and technical knowledge related to finance, accounting, management administration and risk management |

Notes: 1. Director Toshiro Yonemura retired as a member of the Nomination Committee on May 28, 2024, and as a Director on May 27, 2025.

2. Director Shinji Wada passed away on December 29, 2024, and therefore retired from his position as Director of the Company on the same day.

3. Jenifer Simms Rogers and Elizabeth Miin Meyerdirk resigned from their position as Director of the Company on March 11, 2025.

(2) Functions and roles of Outside Directors and Outside Audit & Supervisory Board Members

The Outside Directors and Outside Audit & Supervisory Board Members provide supervision or audits and advice and proposals from an external perspective based on their respective expertise and wide-ranging, high-level experience and insight into management from an objective and neutral standpoint with no risk of conflict of interest with general shareholders, and fulfill the function and role of ensuring valid and appropriate decision- making and business execution by the Board of Directors.

6. Exchange of opinions with Outside Directors and Outside Audit & Supervisory Board Members

In addition to participating in meetings of the Board of Directors, Outside Directors and

Outside Audit & Supervisory Board Members meet with the Representative Directors, Directors, Standing

Audit & Supervisory Board Members, and others. These meetings, including Management Opinion Exchange

Meetings, are held on a regular and as-needed basis. The themes are set for each of the meetings, centered on

various management issues and matters of high social concern. Reports are provided by Directors, the internal

control divisions, and so forth regarding the status of business execution and internal control, and

explanations are given in response to questions from the Outside Directors and Outside Audit & Supervisory

Board Members, who also express their opinions regarding the Company's management, corporate governance, and

other topics based on their respective expert knowledge, experience, and insights. In these and other ways,

the Outside Directors and Outside Audit & Supervisory Board Members exchange frank and lively opinions.

The Outside Directors and Outside Audit & Supervisory Board Members also exchange opinions with the

Directors and Audit & Supervisory Board Members, etc. of operating companies.

Through these

activities, Outside Directors supervise operational execution, and Outside Audit & Supervisory Board

Members perform audits of operational execution and accounting practices.

What is the Management Opinion Exchange Meeting?

Comprising all the Company's Directors and Audit & Supervisory Board Members, the Management Opinion Exchange Meeting is a meeting body aimed at explaining in advance the proposals at the Board of Directors meetings to the Directors and the Audit & Supervisory Board Members, as well as sharing information on the management and business strategies of the Company and operating companies.

7. Activities of the Board of Directors

(1) Setting the dates of the meetings of the Board of Directors and securing deliberation time

The meetings of the Board of Directors of the Company are basically held once per month, and are chaired by a Director selected by the Board of Directors.

| Item | Details |

|---|---|

| Setting the dates of the meetings of the Board of Directors | Considering the increase in the number of Outside Directors and Outside Audit & Supervisory Board Members, as well as the fact that some Directors reside overseas, the Company begins preparations early and sets the dates of meetings six months prior to the commencement of the fiscal year. |

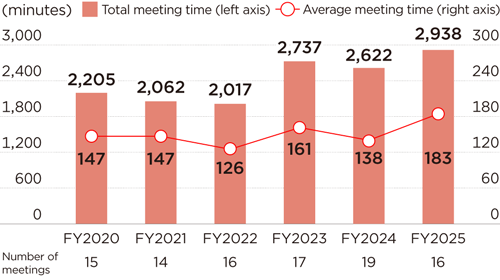

| Deliberation time |

|

| Matter for resolution and reporting | If further deliberation is required, the agenda, etc. after being redrafted and improved to reflect the observations of the Board of Directors, is again presented as follow-up deliberations at the next and subsequent meetings of the Board of Directors, and is accordingly confirmed and resolved, etc. |

Deliberation time of the meeting of the Board of Directors*

- * The period of the calculations was from March of the year to February of the following year

(2) Matters for deliberation

The Board of Directors deliberates on a wide range of matters, with the major topics and themes as follows (examples provided are not exhaustive).

| Major matters for deliberation | Examples of major themes discussed from May 2024 to April 2025 |

|---|---|

|

1. Matters determined by laws and regulations, including the Companies Act

|

|

|

2. Matters determined by the Corporate Governance Code

|

|

| Important topics for FY2024 | |

| I. Monitoring of action plans for accelerated growth |

|

| II. Consideration of optimal group structure |

|

| III. Strengthening investor engagement |

|

| IV. Promotion of initiatives related to governance and human capital management |

|

8. Evaluation of the Board of Directors' effectiveness [CGC Supplementary Principle 4.11.3]

(1) Fundamental approach to evaluation of the Board of Directors' effectiveness

The Company believes that it is important for the Board of Directors to function effectively in order to improve corporate governance and maximize corporate value. For this reason, the Company implements an important PDCA cycle in which it evaluates the effectiveness of the Board of Directors ("Board of Directors' evaluation ") every year through objective analysis and thorough discussion, and links the results to concrete actions to further improve the effectiveness of the Board of Directors.

In addition, the Company has established the following policy regarding the Board of Directors' evaluation.

Board of Directors' evaluation implementation policy

- 1. The evaluation shall basically be a "self-evaluation," to be performed each year by all Directors and all Audit & Supervisory Board Members.

- 2. Progress of the important topics set in the previous year's Board of Directors' evaluation shall be confirmed and evaluated.

- 3. With regard to the Board of Directors' evaluation process (conducting surveys and interviews, utilizing third-party organizations, etc.), the Board of Directors will review the necessity of revisions on an annual basis, based on the evaluation of the Board of Directors in the previous fiscal year.

(2) FY2024 Board of Directors' evaluation process

The evaluation process for FY2024 was reviewed by the Board and conducted as follows.

| Evaluators | All directors (15) and Audit & Supervisory Board members (5) |

|---|---|

| Third-party organization | Sumitomo Mitsui Trust Bank, Limited (“the third party”) |

| Scope of evaluation | Board of Directors, Nomination Committee, Compensation Committee, Audit & Supervisory Board, and individual directors |

| Evaluation process |

|

| Outline of survey |

|

Note: The 15 directors represented by the evaluators include Shinji Wada, who passed away on December 29, 2024 and retired on the same day, Joseph Michael DePinto, who resigned on March 9, 2025, and Jenifer Simms Rogers and Elizabeth Miin Meyerdirk, who resigned on March 11, 2025.

(3) Results of Board of Directors' evaluation

Results of the FY2024 Board of Directors’ evaluation, as resolved at the Board meeting held on April 17, 2025, as well as important topics for the Board in FY2025, are as follows.

Summary of evaluation

- 1. In FY2024, the Board of Directors set the key themes for the FY2024 Board of Directors meetings based on the issues identified in the FY2023 Board of Directors meeting effectiveness evaluation and the action plans announced on April 10, 2024, and has been working to address these issues.

- 2. On April 18, 2024, the Company formulated a policy to separate the positions of chairperson of the board of directors and chief executive officer (CEO), and Mr. Dacus, an independent outside director, has been responsible for managing the board of directors as chairperson of the board of directors. As a result, the agenda for board meetings has been narrowed down from an objective perspective, and more appropriate management has become possible.

- 3. In terms of the operation of the meeting, there was a particular focus on reporting and discussion throughout the year on the key themes for the Board of Directors in FY2024, and progress was made on the action plans. On the other hand, there is room for improvement in terms of the frequency of reporting and the speed of initiatives.

- 4. Each Director and Audit & Supervisory Board Member also conducted deliberations from a more diverse range of perspectives through free and open discussions based on their knowledge, experience and abilities. As a result, the Board of Directors has been able to fulfill its roles and responsibilities, including its monitoring function, appropriately, while also making use of the voluntary committees (Nomination Committee, Compensation Committee, and Special Committee), and has been able to ensure their effectiveness. We will continue to work to further improve the effectiveness of the Board of Directors by further enhancing monitoring and strengthening the cooperation between voluntary committees and the Board of Directors.

- 5. When Alimentation Couche-Tard (ACT) made a non-binding takeover bid for the Company in July 2024, a Special Committee was promptly formed consisting of independent outside directors, and since then, discussions have been held continuously from the perspective of improving shareholder value and corporate value, and the details of these discussions have been reported to the Board of Directors on a regular basis.

Important topics for the Board in FY2025

The following have been designated as important topics for the Board of Directors in FY2025.

1. Thorough monitoring in the final year of the medium-term management plan

2. Formulation of new strategies (plans) under the new system and the establishment of a monitoring system

3. Redefining the role of 7&i (the holding company) and its board of directors, based on the above 1 and 2

- *We will also steadily implement the various issues raised in the 2024 Board of Directors' evaluation (summary provided at the end of this page).

In order to ensure the steady promotion and implementation of the important topics for FY2025, we have reflected them in the annual agenda for the Board of Directors, and ensured that the Board of Directors has an opportunity to consider and confirm them. The annual agenda for the Board of Directors is regularly reviewed and revised as necessary, taking into account the progress and implementation status of the priority themes.

Going forward, we will continue to work to improve the effectiveness of the Board of Directors' evaluation, in order to achieve sustainable growth and increase corporate value over the medium to long term.

〈Examples of issues raised in the FY2024 Board of Directors' evaluation〉

1. Monitoring of steady progress on the important topics for the Board of Directors meeting in FY2024

- Further swift action is needed on important topics.

2. The role of holding companies and the composition of Board of Directors

- Considering changes in the group structure, it is necessary to continue discussions on the role of the holding company and the composition of the Board of Directors based on these discussions.

3. Initiatives to streamline deliberations

- In order to secure more time for deliberation on important matters, it is necessary to narrow down the agenda appropriately and further improve the quality of information provided to the Board of Directors.

4. Appropriate identification and monitoring of risks by the Board of Directors

- It is necessary to further enhance the appropriate explanation of the risk situation at the time of resolution, including investment projects, and post-decision monitoring.

5. Improving the performance of internal and external directors

- In order to further improve the effectiveness of the Board of Directors, measures are needed to deepen understanding of the business and corporate governance

6. Information sharing among committees and meeting bodies, and in-depth discussion of specific issues (Nomination Committee, Compensation Committee, etc.)

- It is necessary to further expand opportunities for communication between the executive side and the Board of Directors, as well as between Directors and Audit & Supervisory Board Members.