- Top

- Investor Relations

- Management Policy

- Corporate Governance

- Group Governance Framework Driving Corporate Value Creation

Group Governance Framework Driving Corporate Value Creation

Last update: June 2, 2021

Group governance using a holding company system

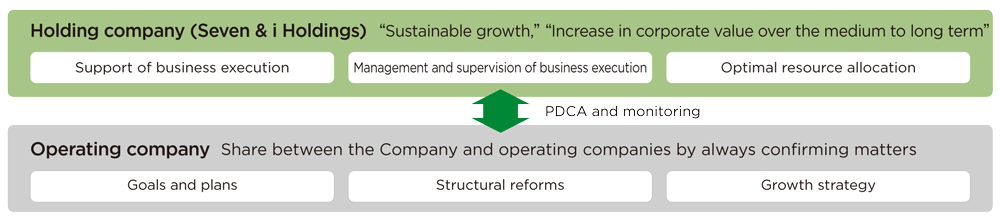

Based on the Group's philosophy and management policies, we employ a Group governance framework based on a holding company system as a mechanism to drive the creation of Group corporate value, not only in the short term but also over the medium to long term.

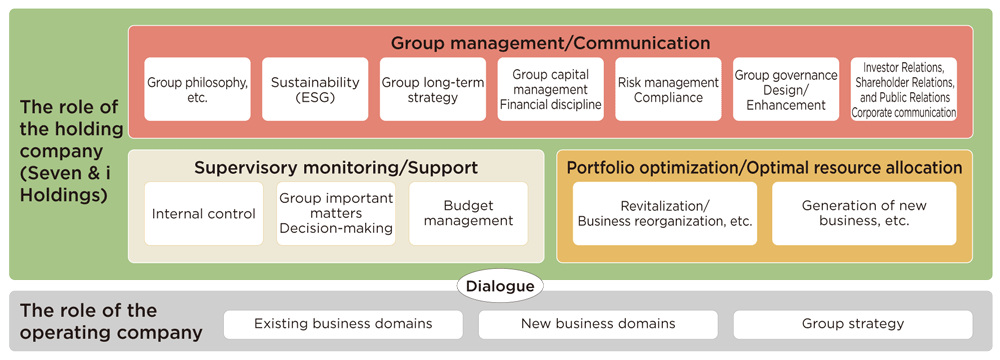

As the holding company overseeing the Group, in order to achieve sustainable growth for the Group and to increase corporate value over the medium to long term, the Company supports and supervises management execution by operating companies, as well as optimally allocates resources to them. In addition, the Company is responsible for "Group management," including disseminating the Group philosophy, drawing up sustainability policies and long-term Group strategies, managing the Group's capital and maintaining financial discipline, enhancing the risk management and compliance system, and enhancing Group governance, as well as "Group communication," including investor relations, shareholder relations, and public relations activities.

Meanwhile, each operating company under the Company's umbrella, while demonstrating autonomy, aggressively performs structural reforms and growth strategies utilizing the PDCA cycle with respect to its own business area, based on the goals and plans established through dialogue with the Company, and fulfills their own responsibilities, striving to increase corporate value and improve capital efficiency.

Based on the clear division of roles among the Group companies, we will steadily execute the Medium-Term Management Plan, realize the management philosophy and management policies, and strive to increase Group corporate value, by having closer and stronger dialogue and collaboration between us, the holding company and operating companies.

Mechanism for creating corporate value based on enhanced dialogue and collaboration with operating companies