- Top

- Investor Relations

- Management Policy

- Corporate Governance

- Roles of Corporate Pension Funds as Asset Owners

Roles of Corporate Pension Funds as Asset Owners

[CGC Principle 2.6]

Last update: May 30, 2025

Investment management of the Group's corporate pensions is operated mainly by Seven & i Holdings Employees' Pension Fund (the "Corporate Pension Fund").

The Company confirms that the Corporate Pension Fund performs the roles of corporate pension funds as asset owners.

In addition, the Corporate Pension Fund has expressed its agreement with and acceptance of the Asset Owner Principles.

1. Scheme of the Corporate Pension FundUpdated

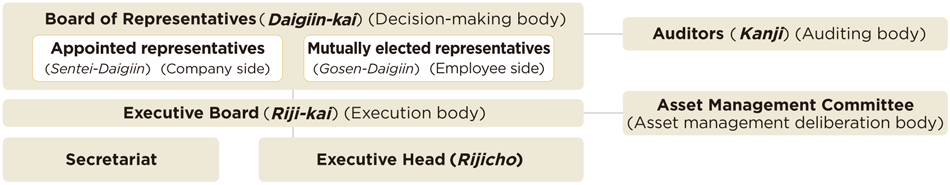

Organizational chart of the Corporate Pension Fund (as of May 30, 2025)

The Board of Representatives consists of an equal number of appointed representatives (company side) and mutually-elected representatives (employee side); the Board confirms the status of asset management twice a year and resolves the investment policy for investment portfolios as necessary. The Executive Board executes business based on the investment policy.

As an asset management deliberation body, the Asset Management Committee consists of members belonging to finance and accounting divisions of the Group and performs monitoring every two months based on their expert knowledge.

In addition, an Investment Director has been appointed to enable expert investment management, including monitoring of investment managers, and personnel with knowledge of finance and human resources have been assigned to the Secretariat.

2. Management of the Corporate Pension Fund

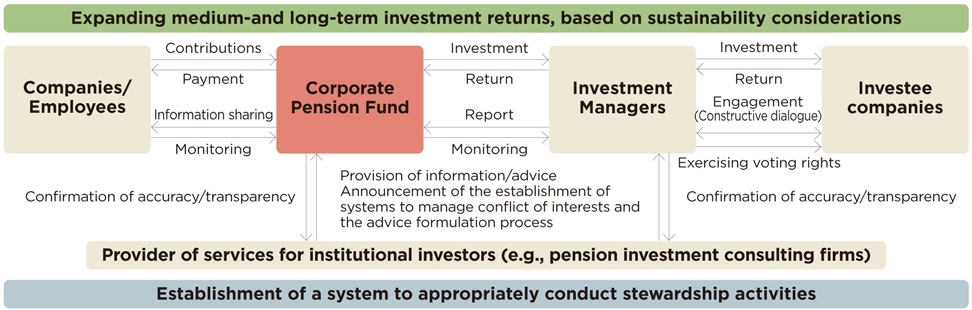

Investment flow

The Corporate Pension Fund confirms that all investment managers for domestic shares have accepted the Stewardship Code.

The Company monitors investment managers regarding their constructive dialogue with investee companies and status of exercising voting rights, and on those occasions, confirms their status, including specific instances of stewardship activities. Further, the Company confirms the accuracy and transparency of the information provided by the pension investment consulting firms, and shares information on these activities and investment results with employees, etc. via regularly published company newsletter and other means.

Conflicts of interest are appropriately managed by executing a discretionary agreement with each investment manager for selection of individual investee companies and exercise of voting rights.