- Top

- Investor Relations

- Management Policy

- Corporate Governance

- Compensation for Board of Directors and Audit & Supervisory Board Members

Compensation for Board of Directors and Audit & Supervisory Board Members [CGC Principle 3.1(iii)]

Last update: May 30, 2025

Ⅰ. Policies and procedures in determining the compensation of Directors and Audit & Supervisory Board MembersUpdated

1. Basic Views on Compensation for Directors and Audit & Supervisory Board Members

The Company considers the compensation system for directors and audit & supervisory board members of the Company (the “Directors and Audit & Supervisory Board Members”) to be “the important measures to enhance the motivation and morale of Directors and Audit & Supervisory Board Members and to take appropriate risk for the sake of continued growth of the medium- and long-term corporate value and sustainable growth of our group based on a basic view on corporate governance,” and build and operate the system based on the points set forth below.

- Emphasis is placed on the link between the business performance and corporate value of our group, and establishing a system that further enhances the motivation and morale to contribute to the continuous improvement of business performance and corporate value over the medium to long term.

- To secure highly capable human resources who will enhance corporate governance through appropriate supervision and auditing of the execution of operations, and provide compensation levels and systems commensurate with responsibilities.

- In order to secure human resources with global experience and a high level of expertise in our business domains and to further enhance our corporate value, we will establish compensation levels and systems that are competitive in the global human resources market.

- Ensure the objectivity and transparency of the compensation decision process, and establish a compensation system trusted by all stakeholders.

- With regard to the design of a specific compensation system for Directors and Audit & Supervisory Board Members, continue to consider to tailor it more appropriately in light of future trends in legal systems and society.

Introduction of a non-financial indicator

The Company, aiming for a balance of corporate value and social value, added a target to reduce the amount of CO2 emissions under the environmental declaration called『GREEN CHALLENGE 2050』made in May 2019, as the KPI for performance-based and stock-based compensation from the fiscal year ended February 28, 2021.

In addition, the degree of improvement in employee engagement will be added as the KPI for performance-based and stock-based compensation from the fiscal year ending February 28, 2023 to further promote the creation of an environment that allows various human resources to exercise their abilities.

2. Compensation Levels

The levels of compensation for Directors and Audit & Supervisory Board Members will be determined, taking into consideration various fundamentals in the business content and the business environment of the Company, with reference to the compensation level of directors and audit & supervisory board members in major companies of the same size as the Company based on market capitalization and revenues, etc.

3. Compensation Composition

- (1) Operating Directors

-

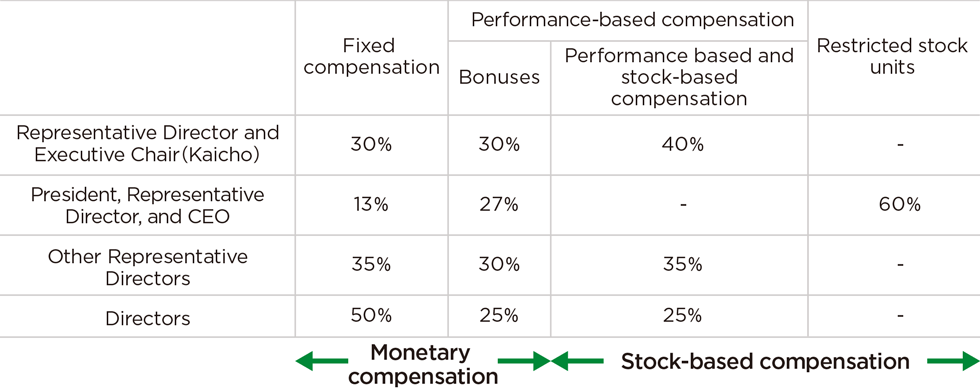

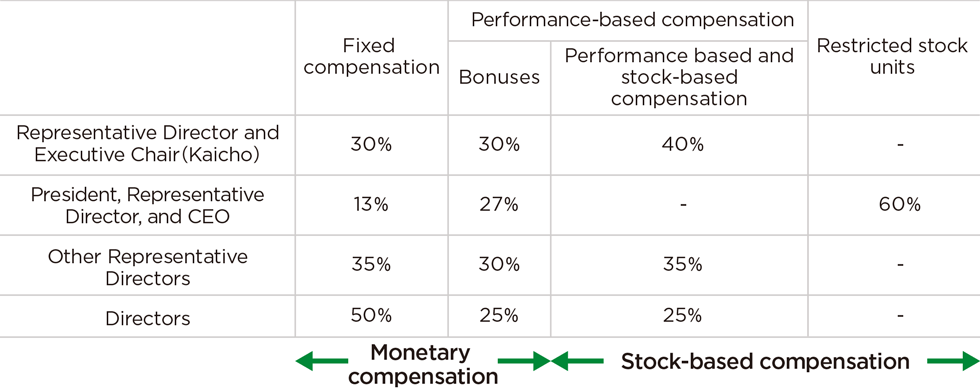

(a) Ratio of compensation composition

The ratio of compensation composition of operating Directors(*1) is roughly as follows:

Due to its operating structure, the Company’s performance-based and stock-based compensation system is currently only applicable to persons who reside in Japan. Also, to share value with shareholders and provide further incentive towards sustainable improvements to the Company’s corporate value, separately from the performance-based and stock-based compensation system, Mr. Dacus, as President, Representative Director, and CEO (*2) is also eligible for restricted stock units that are based on fulfillment of commitments over a certain period.

- *1Calculated on the assumption that performance-based bonuses and performance-based and stock-based compensation are based on a standard compensation amount.

- *2The basic compensation ratio of fixed compensation, performance-based bonuses, and restricted stock units for Mr. Dacus generally is set at 1:2:4.5. However, the ratio of fixed compensation may be increased if the Company pays certain allowances to persons who reside overseas.

(b) Composition

- iFixed Compensation

- A fixed compensation commensurate with the responsibilities for each position will be paid.

- Compensation will be paid monthly during the term of office.

- After deliberation and reporting by the Compensation Committee, and based on a decision by the Board of Directors, it is possible to pay certain allowances to persons who reside overseas as part of their base compensation.

- After deliberation and reporting by the Compensation Committee, and based on a decision by the Board of Directors, an executive allowance may be paid according to position.

- iiPerformance-based bonuses

- Short-term incentive compensation will be a performance-based cash compensation that varies based on the company’s business performance and individual evaluations, etc., for the relevant fiscal year.

- Compensation will be paid annually after the company's business performance and individual evaluations, etc., for the relevant fiscal year have been confirmed.

- Performance-based bonuses for Mr. Dacus, who is the President, Representative Director, and CEO, and those for other Directors, are designed somewhat differently considering the differences between their duties and responsibilities.

< Performance-based bonuses for Mr. Dacus, as the President, Representative Director, and CEO >

- The KPI (Key Performance Indicator), percentages, and evaluation objectives related to performance-based bonuses for Mr. Dacus will be determined by the Board of Directors. This decision by the Board of Directors will be based on reports received from the Compensation Committee, which deliberates taking into account the KPI that will be prioritized in the Company’s new growth strategy and measures to reform the Company’s capital structure and business, as well as the Company’s previous KPI used for performance-based bonuses indicated below.

- With regard to the coefficient for bonuses used as performance-based compensation, the Company will set a wider range of the coefficient so that bonuses will be more affected by the link to business performance.

< Performance-based bonuses for other directors >

- The KPIs for performance-based bonuses is per the table below. In order to evaluate the capability of the main business to make a profit in cash during a given fiscal year and to incorporate the shareholder perspectives, consolidated net income is also used together as a KPI.

Key Performance Indicators for performance-based bonusesKPI Ratio Purpose of Evaluation (a) Consolidated Operating CF

(excl. financial services)*60% Evaluation of profit-making capability in the main business in cash (b) Consolidated Net Income 40% Evaluation of the degree of achievement of budgeted net income - < The coefficient formula pertaining to performance-based bonuses >

Coefficient pertaining to performance-based bonuses = {(a) + (b)} × (c)

(a) “Consolidated operating CF” related coefficient × 60%

(b) “Consolidated net income” related coefficient × 40%

(c) “Individual evaluations” related coefficient- When evaluating KPI, the range of compensation of Representative Directors is set wider by using different coefficients pertaining to performance-based bonuses from other Directors, so that the compensation of Representative Directors will be more affected by the link to performance.

- The coefficient pertaining to performance-based bonuses will vary depending on, not only an evaluation of KPI, but also individual evaluations.

- *Managerial accounting figures based on NOPAT excluding financial services.

- iiiPerformance-based and stock-based compensation

- Performance-based and stock-based compensation currently only is applicable to Directors who reside in Japan.

- Medium- and long-term incentive compensation is a performance-based and stock-based compensation that varies based on the company’s business performance, management indicators and non-financial indicators, etc., (the introduction of the BIP Trust system* as the stock-based compensation system was resolved at the Annual Shareholders’ Meetings held in May, 2019).

- Performance-based and stock-based compensation will enhance sharing profits and risks with our shareholders who have medium- and long-term perspectives by providing points during the term of office based on which shares will be delivered.

- The initial covered period shall be four fiscal years starting from the fiscal year ended February 29, 2020 and the subsequent covered periods shall be per three fiscal years.

- Shares will be delivered to Directors upon their retirement.

- Points to be granted for each fiscal year will be calculated by multiplying the standard points based on their position by a coefficient pertaining to performance-based and stock-based compensation and will vary between 0% and 200% depending on the achievement level of targets, etc.

- The KPI for performance-based and stock-based compensation is per the table below. In order to incorporate medium- and long-term shareholder perspectives, consolidated ROE and consolidated EPS are used as indicators and the degree of achievement will be evaluated.

- The Company, aiming for a balance of corporate value and social value, added a target to reduce the amount of CO2 emissions under the environmental declaration called “GREEN CHALLENGE 2050” made in May 2019, as the KPI for performance-based and stock-based compensation from the fiscal year ended February 28, 2021.

- The degree of improvement in employee engagement was added as a KPI for performance-based and stock-based compensation from the fiscal year ended February 28, 2023 to further promote the creation of an environment that allows various human resources to exercise their abilities.

- *A BIP (Board Incentive Plan) trust is an incentive plan for officers established with reference to a performance share plan and a restricted share compensation plan in the U.S.

Key Performance Indicators for performance-based and stock-based compensationKPI Ratio Purpose of Evaluation (a) Consolidated ROE 60% Evaluation of profitability against equity (b) Consolidated EPS 40% Evaluation of net income from shareholder perspectives (c) CO2 Emissions See the formula below Evaluation of the degree of promoting a reduction in the environmental burden (d) Employee Engagement Evaluation of the degree of improvement in employee engagement* * Comprehensive evaluation by the Compensation Committee

- < Coefficient formula pertaining to performance-based and stock-based compensation >

Coefficient pertaining to performance-based and stock-based compensation = {(a)+(b)}× {(c)+(d)}

(a) “Consolidated ROE” related coefficient × 60%

(b) “Consolidated EPS” related coefficient × 40%

(c) “CO2 emissions” related coefficient

(d) “Employee engagement” related coefficient

- When evaluating KPI, the range of compensation of Representative Directors is set wider by using different performance-based coefficients from other Directors, so that the compensation of Representative Directors will be more affected by the link to performance.

- ⅳRestricted stock units

- The restricted stock units are applicable only to operating Directors who reside overseas (Mr. Dacus, as President, Representative Director, and CEO); thus, there will not be an overlap between these units and the Performance-Based and Stock-Based Compensation System mentioned in item (ⅲ) above.

- Restricted stock units will be delivered as incentive-based compensation conditional on fulfillment of commitments over a certain period of time.

- In the restricted stock unit plan, units for delivery of shares will be provided to Eligible Directors during the relevant Director’s term in office, to share value with shareholders and to provide further incentives toward sustainable improvements to the Company’s corporate value.

- The initial period of eligibility will be the three (3) fiscal years from the fiscal year ending February 28, 2026.

- The delivery, etc. of shares, etc. to Eligible Directors shall be conducted based on a resolution to be passed at the Board of Directors meeting held after the adjournment of the first Annual Shareholders’ Meeting convened after expiration of the aforementioned period of eligibility.

- *A restricted stock unit plan is a system of stock compensation through which Eligible Directors are delivered a number of units determined by the Board of Directors in advance. Conditional on continuous fulfillment of duties as Eligible Directors, a specified number of shares, or the cash equivalent, is issued to Eligible Directors based on the number of vested units after the end of a specified period. Such specific period is the period from the Company’s first Annual Shareholders’ Meeting convened during the number of fiscal years specified by the Board of Directors to the adjournment of the first Annual Shareholders’ Meeting convened after the conclusion of said number of fiscal years.

(c) Malus and Clawback

If a Director who is eligible for each type of compensation engages in serious misconduct or commits a violation, the Board of Directors passes a resolution to change the Company’s past financial statements due to material errors in accounting or accounting fraud, or any similar events to be designated by the Board of Directors, depending on the nature of the relevant compensation, occurs, the Company may choose not to deliver or provide all or a part of each type of compensation (malus) or may request the return of all or a part of each type of compensation delivered or provided to that Director (clawback).

- (2) Outside Directors and Audit & Supervisory Board Members

-

(a) Ratio of compensation composition

The compensation for Outside Directors and Audit & Supervisory Board is fixed compensation only as described in below (b).

(b) Composition

- With an emphasis on further strengthening the independence of Outside Directors and Audit & Supervisory Board Members from management, the compensation of Outside Directors and Audit & Supervisory Board Members consists only of fixed compensation. Performance-based compensation (bonuses and stock-based compensation) will not be paid to Outside Directors and Audit & Supervisory Board Members.

- Compensation will be paid monthly during the term of office.

- Executive allowance according to their position may be paid based on the resolution by the Board of Directors’ meeting after deliberation and reporting by the Compensation Committee.

4. Compensation Governance

- (1) Compensation Committee

-

The Company has established a compensation committee to ensure objectivity and transparency in the procedures for deciding the compensation of Officers, etc. (referring in this policy to Directors, Audit & Supervisory Board Members, and Executive Officers). The committee's chair and the majority of its members are Independent Outside Directors.

- (2) Method of determining compensation

-

This Policy, the basic policy on compensation of Directors and Audit & Supervisory Board Members, is determined by the Board of Directors through deliberations by the Compensation Committee. Based on this Policy, the amount of compensation of each Director is deliberated on by the Compensation Committee in accordance with the evaluation of each Director’s function, degree of contribution, and the group’s results, as well as the degree of achievement of KPI, and then determined by the Board of Directors based on reports received from the Compensation Committee.

The compensation of each Audit & Supervisory Board Member is determined through discussions by the Audit & Supervisory Board Members.

5. Compensation limit for Directors and Audit & Supervisory Board Members

The amount of compensation of directors and Audit & Supervisory Board members is decided within the following compensation limit determined at the Shareholders’ Meeting.

The Company has already abolished the severance payment system for directors and Audit & Supervisory Board members, and no severance payments will be paid to directors and Audit & Supervisory Board members.

- (1) Directors

-

- Monetary compensation

Not more than ¥2 billion per year (and to within ¥0.5 billion per year for Outside Directors (out of the ¥2 billion)—neither limit includes employee salaries paid to Directors who serve concurrently as employees) (Resolved at the 20st Annual Shareholders' Meeting held on May 27, 2025) - Stock-based compensation

Performance based and stock-based compensation

3 fiscal years/not more than ¥1,200 million(not more than ¥400 million per 1 fiscal year) Limit on the points granted per 1 fiscal year 240,000 points (1 point = 1 common stock)

(Resolved at the 17th Annual Shareholders’ Meeting held on May 26, 2022, separately from monetary compensation. The number of points to be granted per fiscal year was resolved at the 17th Annual Shareholders’ Meeting to be 80,000 points or less, but was adjusted to 240,000 points or less following a 3-for-1 stock split of common stock on March 1, 2024.) - Restricted stock units

500,000 shares per fiscal year (however, after the end of the appointment term, the Company may deliver the total number of common shares corresponding to that term)

In the case of (1) delivery of shares, etc. without consideration, the maximum amount will be an amount calculated by multiplying the amount calculated based on the closing price of the common shares in the Company (“Common Shares”) on Tokyo Stock Exchange, Inc. on the business day immediately preceding the day on which the Company’s Board of Directors passes a resolution concerning the RSU Plan to issue or dispose of Common Shares (“Company Stock Closing Price”) or another fairly appraised amount per share, by the number of Common Shares to be delivered to Eligible Directors. In the case of (2) a contribution in kind, the maximum amount will be the amount calculated by multiplying the per-share amount to be paid, which is to be determined by the Company’s Board of Directors based on the Company Stock Closing Price and is to be an amount that is within a scope that is not particularly advantageous to the Eligible Directors who receive Common Shares by the number of Common Shares to be delivered to Eligible Directors.

(Resolved at the 20st Annual Shareholders' Meeting held on May 27, 2025) - Monetary compensation

- (2) Audit & Supervisory Board members

-

- Monetary compensation

Not more than ¥200 million per year

(Resolved at the 14th Annual Shareholders' Meeting held on May 23, 2019)

- Monetary compensation

Compensation for 7-Eleven, Inc.’s CEO

The compensation structure of 7-Eleven, Inc.’s CEO consists of “fixed compensation,” which is fixed pecuniary compensation, and “short-term incentives” and “long-term incentives,” which are performance-based pecuniary compensation, emphasizing the relationship between performance and corporate value and aiming to increase morale and the motivation to contribute to the mid- to long-term enhancement of 7-Eleven, Inc.’s performance and corporate value. In order to encourage the achievement of performance targets, more than 90% of the total compensation is performance-based, with short-term incentives assessed over one year and long-term incentives assessed over three years, based on the degree of target achievement and value enhancement. The compensation levels of 7-Eleven, Inc.’s CEO refer to the compensation levels in the U.S. market, and factor in the knowledge of external evaluation organizations, from the perspective of securing and retaining talented personnel, etc. The amount of compensation for each business year is ultimately determined by resolution of the Board of Directors of 7-Eleven, Inc., after deliberation by the Company’s Compensation Committee, to secure objectivity and transparency in the decision-making process.

II. Compensation in FY2024Updated

1.Total amount of compensation, etc. for each officer category, total amount of compensation, etc., by type, and number of eligible officers

| Classification of Directors/Audit & Supervisory Board Members | Number of eligible Directors/Audit & Supervisory Board Members | Total amount of compensation, etc. (Millions of yen) |

Total amount of compensation, etc., by type (Millions of yen) |

|||

|---|---|---|---|---|---|---|

| Fixed compensation | Performance-based compensation | |||||

| Bonus | Stock-based compensation (BIP Trust) | Non-monetary compensation, etc., among those listed on the left | ||||

| Directors (excluding Outside Directors) |

7 | 731 | 266 | 205 | 259 | 259 |

| Outside Directors | 9 | 284 | 284 | ― | ― | ― |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) |

2 | 84 | 84 | ― | ― | ― |

| Outside Audit & Supervisory Board Members | 3 | 70 | 70 | ― | ― | ― |

- (Notes)

- The above includes one (1) Inside Director who retired at the conclusion of the 19th Annual Shareholders’ Meeting held on May 28, 2024 and one (1) Outside Director who passed away on December 29, 2024 and retired from his position on the same day.

- The aggregate amounts of compensation, etc. of Directors shown above do not include amounts paid as salaries for employees to Directors who serve concurrently as employees.

- It was resolved at the 1st Annual Shareholders’ Meeting held on May 25, 2006 that the annual amount of compensation paid to Directors shall not exceed 1 billion yen (not including amounts paid as salaries for employees). The number of Directors was 16 in accordance with the resolution of this Shareholders’ Meeting.

- The 17th Annual Shareholders’ Meeting held on May 26, 2022, resolved as follows regarding compensation amounts for Directors’ stock-based compensation (BIP Trust).

The number of Directors was 4 in accordance with the resolution of this Shareholders’ Meeting.

3 fiscal years / not more than 1.2 billion yen (however, for eligible periods beginning in FY2019, 1.0 billion yen as total for four fiscal years)

Limit on the points granted per fiscal year: 80,000 points (1 point = 1 share of common stock)

Following a share split with an effective date of March 1, 2024, whereby each share of common stock was split into 3 shares, the limit on the number of points granted per fiscal year was adjusted to 240,000 points. - It was resolved at the 14th Annual Shareholders’ Meeting held on May 23, 2019 that the annual amount of compensation paid to Audit & Supervisory Board Members shall not exceed ¥200 million. The number of Audit & Supervisory Board Members is five (5) in accordance with the resolution of this Shareholders’ Meeting.

- The amount of performance-based compensation above includes the provision for bonuses to Directors and Audit &Supervisory Board Members and the provision for allowance for stock payments in the 18th fiscal year.

- Stock-based compensation (BIP Trust) was granted to five (5) individuals, including one (1) internal Director who retired.

- Breakdown of total amount of non-monetary compensation to Directors (excluding Outside Directors) is 259 million yen of stock compensation (BIP trust).

2.KPI results pertaining to performance-based compensation in FY2024

Key Performance Indicators for performance-based bonuses

| KPIs | Ratio | Purpose of evaluation | Targets for FY2024 |

Results in FY2024 |

|---|---|---|---|---|

| (a) Consolidated Operating Cashflows (Excluding Finance*) | 60% | Evaluation of the ability to earn cash from core business | ¥841.7 billion | ¥783.2 billion |

| (b) Consolidated Net Income | 40% | Evaluation of the degree of achievement of budgeted net income | ¥293 billion | ¥173 billion |

- * Managerial accounting figures based on NOPAT excluding finance business

Key Performance Indicators for performance-based and stock-based compensation

| KPIs | Ratio | Purpose of evaluation | Targets for FY2024 |

Results in FY2024 |

|---|---|---|---|---|

| (a) Consolidated ROE | 60% | Evaluation of profitability against equity | 7.8% | 4.5% |

| (b) Consolidated EPS | 40% | Evaluation of net income from shareholders’ viewpoint | ¥112.05 | ¥66.62 |

| (c) CO2 Emissions | See the formula below | Evaluation of the degree of promotion of reducing the environmental burden | 1,898,449t | 1,813,924t |

- Formula of the coefficient for performance-based stock compensation:

- Coefficient for performance-based stock compensation = {(a) + (b)} × {(c) + (d)}

- (a) “Consolidated ROE” related coefficient × 60%

(b) “Consolidated EPS” related coefficient × 40%

(c) “CO2 emissions” related coefficient

(d) “Employee engagement” related coefficient

- (Notes)

- Targets and results for “CO2 Emissions” are from FY2023.

- The target value for “CO2 Emissions” is set for each fiscal year based on the assumption of reducing emissions equally each year to achieve the target value for FY2030, as defined in GREEN CHALLENGE 2050, which aims for a 50% reduction in emissions from Group store operations compared to FY2013.

- “Employee engagement” related coefficient has been decided using the comprehensive evaluation by the Compensation Committee.