- Top

- Investor Relations

- IR Library

- Management Report (Integrated Report)

- Message from the CFO

Message from the CFO

Striving to achieve the targets of the financial KPIs that support the successful execution of our MTMP and the growth strategy beyond it

Yoshimichi MaruyamaDirector, Managing Executive Officer Chief Financial Officer (CFO)

Toward achieving the goals of the MTMP

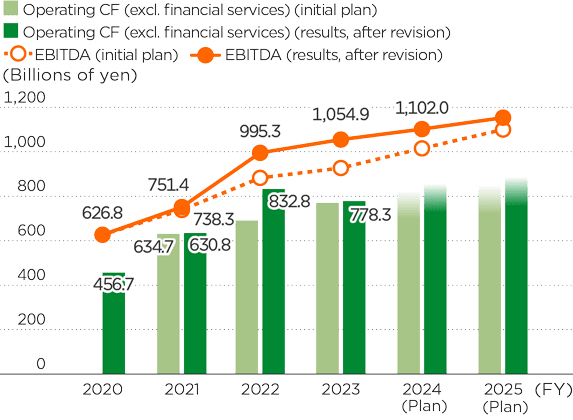

The basic financial policy of the Medium-Term Management Plan 2021–2025 (MTMP) is to expand returns that exceed the cost of capital, enhance cash flow generation, and continuously improve corporate value. To achieve this, we have established key performance indicators (KPIs) and their targets from three perspectives: quantitative expansion, qualitative improvement, and ensuring financial soundness. We made upward revisions to the KPI targets in March 2023.

Regarding quantitative expansion, our cash-generating capability has been steadily increasing, particularly in domestic and overseas convenience store (CVS) operations. We are now on track to achieve our targets for both EBITDA and operating cash flow (excluding financial services).

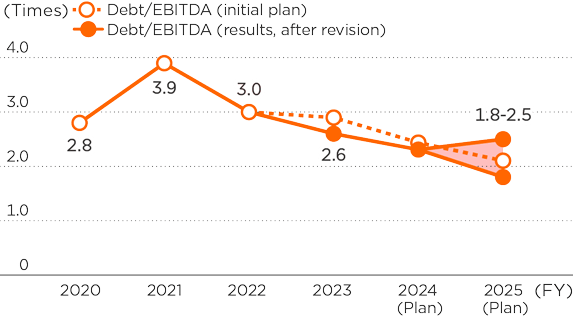

In terms of ensuring financial soundness, we have seen improvement in our key indicator, the Debt/EBITDA ratio, despite executing unplanned M&A activities. This improvement is due to the repayment of interest-bearing debt as planned and the completion of the transfer of shares of Sogo & Seibu Co., Ltd., which had substantial interest-bearing debt. However, we revised the Debt/EBITDA ratio target for FY2025 in April 2024, adjusting it from below 1.8 times to a range of 1.8 to 2.5 times. This adjustment reflects recommendations from the Strategy Committee and is intended to promote our growth strategy aimed at enhancing the Group’s medium- to long-term corporate value and shareholder value. It involved re-evaluating the balance between ensuring financial soundness and the capacity to take on debt for supporting growth investments, with a focus on optimal capital structure. This adjustment is based on the principle that, in the absence of high-quality strategic investment opportunities, we will lower leverage to 1.8 times as initially planned to prepare for future significant investments. Concurrently, we will disclose the extent to which we can allocate funds for investments while preserving our current financial soundness.

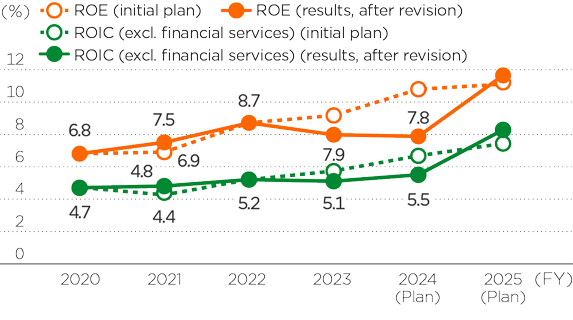

For our qualitative improvement indicators—ROE and ROIC—we exceeded our initial targets through to FY2022. However, in FY2023, our performance significantly fell short due primarily to initiatives such as the transfer of Sogo & Seibu shares and other efforts to optimize the business portfolio. In FY2024, we expect to continue falling below our initial targets due to upfront losses from fundamental business portfolio reforms and the acceleration of strategic investments, particularly in CVS operations in the United States and Japan, as we work toward achieving MTMP goals.

Therefore, from a financial perspective, we recognize that the key to achieving the FY2025 targets lies in how effectively we implement qualitative improvement measures in FY2024.

To this end, first we need to evolve the Group’s business model to accelerate growth and enhance capital efficiency. Next, we need to expedite the disposal or restructuring of assets and businesses that are not generating profits or have low returns. It is important to implement these two measures by FY2024 to maximize the benefits in FY2025. In that sense, FY2024 will be a pivotal year for us.

Additionally, the macroeconomic environment surrounding consumer spending has changed significantly from our initial expectations. One factor is that, particularly since the second half of 2023, inflation has significantly impacted both Japan and the United States, leading to substantial changes in consumer purchasing behavior. There is also the effect of the weaker yen. To address these changes, we need to accelerate and further evolve the two measures mentioned above.

Consolidated financial KPI

By FY2025: EBITDA ¥1.1 trillion or more, operating CF ¥900 billion or more

- Notes: 1. Operating CF: Management accounting figures based on NOPAT (excluding. financial services)

- 2. Exchange rate: Initial plan 1U.S.$ = ¥107 (FY2021), 1U.S.$ = ¥105 (FY2022–2025)

- 3. Results, after revision: 1U.S.$ = ¥109.90 (FY2021 1U.S.$ = ¥131.62 (FY2022), 1U.S.$ = ¥140.67 (FY2023), 1U.S.$ = ¥145.0 (FY2024), 1U.S.$ =¥116.0 (FY2025) Figures in the initial plan exclude the effect of sale & leaseback.

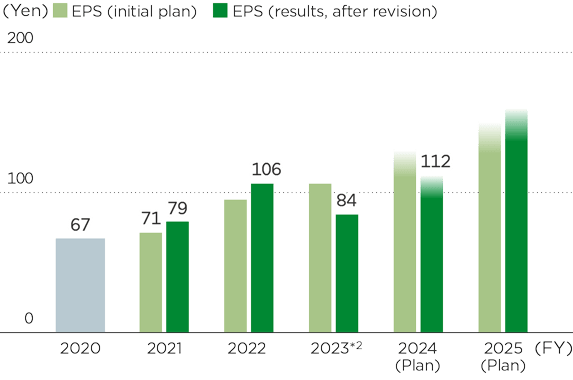

FY2021–2025: EPS growth plan: 18% or more*1

- *1Calculated based on CAGR (Compound Annual Growth Rate) for FY2020

- *2Adjusted figures for the effects of the transfer of the shares of Sogo & Seibu and Barneys Japan

Note: he Company conducted a 3-for-1 common share split on March 1, 2024. “EPS” is calculated as if the share split had occurred at the beginning of the FY2020.

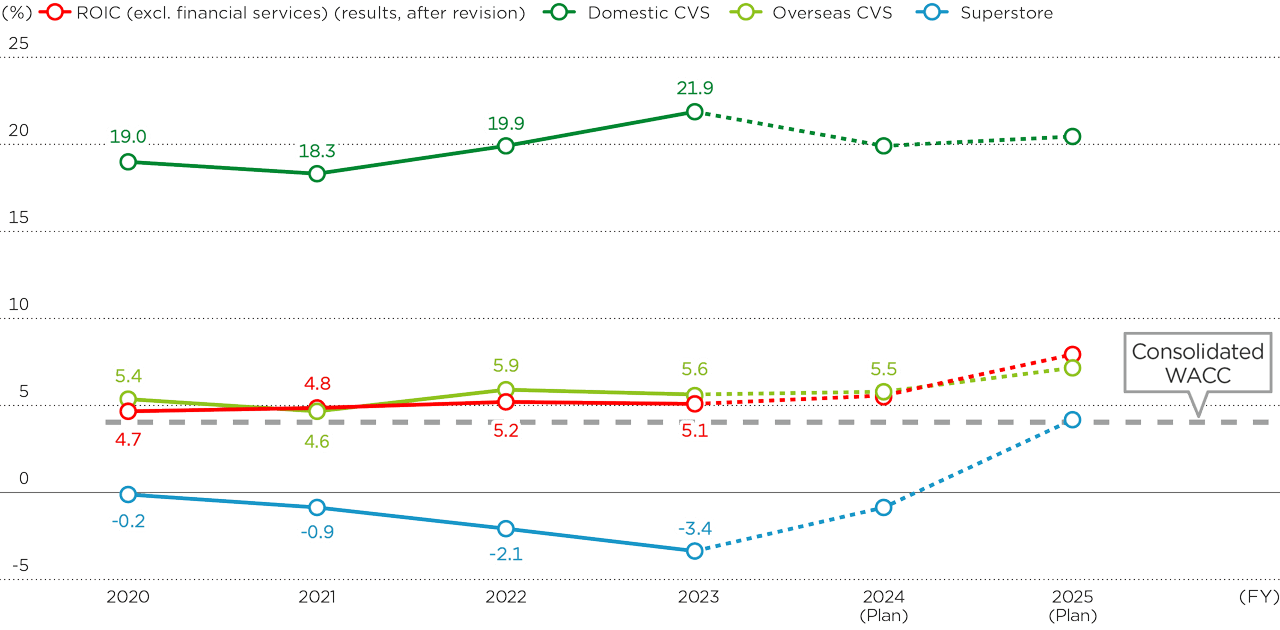

By FY2025: ROE 11.5% or more ROIC 8% or more (excl. financial services)

- Notes: 1. Adjusted figures for the effects of the transfer of the shares of Sogo & Seibu and Barneys Japan

- 2. Figures in the initial plan exclude the effect of sale & leaseback.

- 3. ROIC: {Net income + Interest expense x (1 - Effective tax rate)} / {Owner’s equity + Interest-bearing debt (both the averages of the figures at the beginning and the end of each fiscal year)}

FY2025: Below 1.8 times to 1.8–2.5 times

Note: We changed our FY2025 target to proactively implement strategic investments in the Convenience Store business with more agile and flexible financial discipline, in order to promote the growth strategy of our Group.

For enhancing corporate value and shareholder value

Currently, we are advancing action plans in three areas as determined by the Board of Directors based on recommendations from the Strategy Committee. The main objectives are to evolve the business models of our Group companies to drive growth and improve capital efficiency by reassessing non-performing assets and optimizing the Group’s business structure. We also seek to further enhance investor engagement to ensure that the capital markets recognize these efforts in a timely and appropriate manner. Ultimately, we aim to maximize the Group’s medium- to long-term corporate value and, consequently, shareholder value.

We believe that these action plans are crucial initiatives for achieving our MTMP goals and ensuring sustained growth beyond them. Consequently, FY2024 is extremely important for our success.

Qualitative improvement of North American CVS operations

North American CVS operations, which represent about 60% of the Group’s EBITDA and are central to our growth, face an urgent need to enhance profitability and capital efficiency. A crucial factor in achieving this is the expansion of proprietary merchandise. As inflation persists and customers become more price-sensitive, it is important to promote improvements by increasing the proportion of proprietary merchandise that is more affordable than national brands, while ensuring it maintains comparable quality and high gross profit margins. This approach will drive growth and enhance profitability.

At the same time, cost reduction efforts are essential. In FY2023, 7-Eleven, Inc. (SEI) achieved approximately $308 million in cost savings through the efforts of the Cost Leadership Committee. For FY2024, the cost reduction target has been revised upward from the initial $350 million to $500 million. These initiatives are an effort to reduce not only SG&A expenses but also the cost of goods sold, which will also improve the profit margin.

Transitioning to an optimal Group structure

As part of the Group’s structural reforms, we completed the transfer of shares of Sogo & Seibu in 2023. In superstore (SST), five policies aimed at fundamental reform are progressing according to the roadmap, steadily improving the profit structure. Moving forward, we will focus on measures to further enhance sales and profits to achieve the FY2025 targets of ¥55 billion or more in EBITDA and at least 4% ROIC for Tokyo metropolitan SST operations. Moreover, the SST Committee, where top executives from the Company and related businesses discuss growth strategies, will work on laying out a concrete path toward a potential future IPO.

Strengthening of investor engagement

We have always prioritized dialogue with shareholders and investors. To enhance the frequency and depth of these interactions, we launched IR Day in FY2023, where those responsible for overseeing each business present and engage directly with investors on medium- to long-term business strategies. We are also increasing opportunities for dialogue between outside directors and investors.

We regularly report the opinions and suggestions of our shareholders and investors to our management team and board of directors, and share them with our affiliated operating companies, where they are used to formulate management strategies and milestones.

While our enhanced dialogue opportunities and improved information disclosure have been positively received during overseas roadshows, we acknowledge the need for further improvement in our investor relations and shareholder relations activities and structure. Specifically, there is a demand for more detailed disclosure of quantitative targets and milestones related to achieving our consolidated financial KPIs. We will continue to bolster our disclosures and respond to requests through ongoing dialogue.

Promoting management conscious of cost of capital and stock price

To achieve management conscious of cost of capital and stock price, we disclose not only ROE but also segment-specific ROIC targets. We continuously monitor whether these targets exceed the consolidated cost of capital and the extent of the spread. Given the importance of capital efficiency in domestic and overseas CVS operations—a key pillar of the Group’s growth—the management teams of the company and the three companies responsible for CVS operations, namely SEJ, SEI, and 7IN, convene at the Global CVS Steering Committee to discuss growth strategies as well as review policies and investment criteria. Furthermore, progress toward achieving the FY2025 ROIC target of 4% or more for SST operations is being reviewed by the SST Committee.

In this way, we are coordinating and discussing with each operating company in a timely and appropriate manner, with the goal of implementing effective measures to enhance capital efficiency.

We have received feedback that our stock price appears to be facing resistance, and one possible factor is that our accounting standards might lead to undervaluation compared to global companies. While we adopt Japanese Generally Accepted Accounting Principles (JGAAP), SEI follows U.S. GAAP, and 7-Eleven Australia Pty. Ltd., which we acquired in April 2024, adheres to International Financial Reporting Standards (IFRS), which complicates consolidated accounting. Accordingly, we have begun considering the adoption of IFRS for CVS operations. However, since SST operations are primarily domestic, we will continue to use JGAAP for that segment.

Note: Management accounting figures adjusted for intra-Group capital and financing transactions

Expanding shareholder return

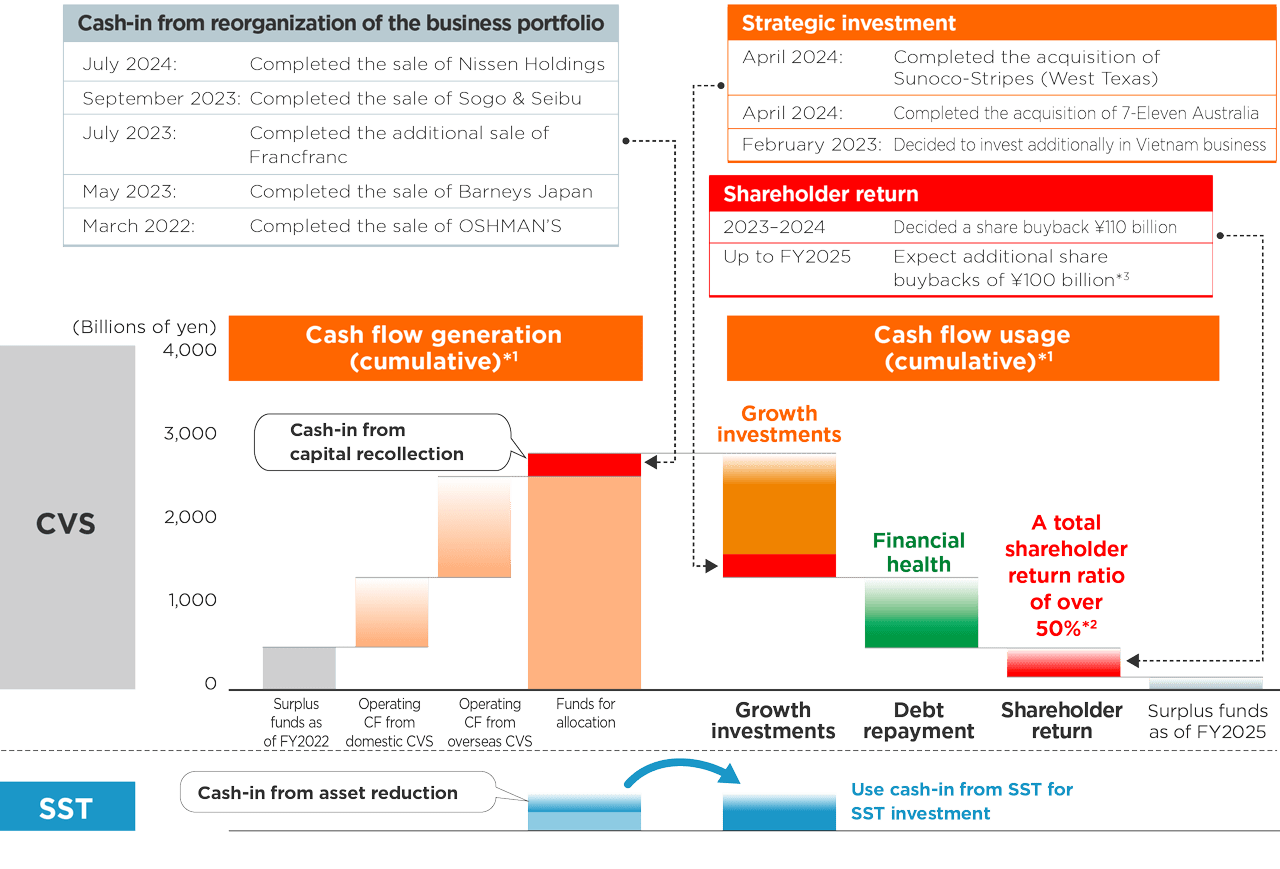

For us, as well as for our shareholders, a key factor is how we enhance our capital-generating capability and allocate that capital toward growth investments, ensuring financial soundness, and expanding shareholder return.

Regarding shareholder return, during the MTMP period to FY2025, in addition to growth investments in domestic and overseas CVS operations, we also plan to allocate a portion of our capital toward repaying interest-bearing debt to restore financial health. Accordingly, in FY2023, we executed share buybacks amounting to ¥110 billion. On top of this, we plan to conduct further share buybacks totaling approximately ¥100 billion by FY2025.

Additionally, considering the nature of our retail business, we have committed to a progressive dividend policy, which ensures either a continuous increase or maintenance of dividend payouts. We will also implement shareholder return measures flexibly based on free cash flow conditions, committing to a total return ratio of 50% or more over the period from FY2023 to FY2025. Also, to create a more investor-friendly environment and expand our investor base, we conducted a stock split effective March 1, 2024.

Since many of our individual shareholders are also customers of the Group’s stores, we have introduced a new shareholder benefit program to encourage long-term support and foster greater shareholder loyalty. This program is expected to optimize the cost of capital and increase liquidity by reducing stock price volatility, thereby enhancing corporate value.

- *1Cumulative figures from FY2023 to FY2025

- *2Cumulative total return to shareholders from FY2023 to FY2025

- *3The share buyback amount may possibly change if large strategic investments (such as M&A) are pursued instead of share buybacks.

Exploring the quantification and metrics of non-financial value

In recent years, as interest in environmental, social, and governance (ESG) matters has increased, there has been growing curiosity about what constitutes non-financial value, which contributes to the Group’s financial value. In response, I highlight that the Group’s most significant non-financial value lies in our ability to develop and build a value chain with partner manufacturers who are essential for creating proprietary merchandise crucial to the growth of our overseas CVS operations. Equally important is the human capital driving this success.

As previously mentioned, the introduction of proprietary merchandise enhances profitability. Moving forward, we will look to quantify the financial impact of expanding our value chain.

Cultivating talent with a focus on capital efficiency

To realize an optimal Group structure, it is essential for each Group company to cultivate and apply talent that practices management conscious of cost of capital and stock price. Based on this awareness, we have established ROIC as a KPI not only on a consolidated basis but also for each operating company. In addition, we provide feedback on engagement with shareholders and investors to the management teams of these operating companies.

Through our continued efforts, understanding of the balance sheet and cost of capital has steadily improved. In particular, by committing both internally and externally to ROIC targets for SST operations, we have seen these concepts become clearly understood at the operational level. Moreover, these metrics have elevated strategic perspectives and increased the number of individuals with a managerial outlook. To further build on these achievements, we will increase opportunities for discussions about financial KPIs with all Group companies.

As mentioned earlier, FY2024 is a crucial year for achieving our MTMP goals and advancing our growth strategy for the future. We will continue to implement each of our current measures meticulously and promptly while engaging in ongoing dialogue with shareholders and investors. Our commitment is to maximize long-term shareholder value and meet the expectations of all stakeholders.