- Top

- Investor Relations

- IR Library

- Management Report (Integrated Report)

- Message from the CEO

Message from the CEO

Leading the charge with decisive action plans

Ryuichi IsakaPresident, Representative Director and CEO

Joined SEVEN-ELEVEN JAPAN CO., LTD. (SEJ), in 1980. Named Director in 2002 and Managing Executive Officer in 2006. After serving as Director and Managing Executive Officer of the Merchandising & Foods Department, was named SEJ’s Representative Director and President in 2009. Appointed Representative Director and President of Seven & i Holdings Co., Ltd. in May 2016.

Formulated action plans following ongoing discussions

In April 2024, Seven & i Holdings announced action plans focused on three key areas to maximize the Seven & i Group’s medium- to long-term corporate value and shareholder value. One is the formulation of concrete action plans to accelerate growth, two is the changes to the Group structure that will enhance our long-term growth and corporate value, and three is the enhancement of investor engagement.

Since assuming the role of CEO, I have significantly shifted the Group’s growth strategy from a general retail business to concentrating our management resources with a core focus on growth in convenience store (CVS) operations in both Japan and the United States. I have been implementing this approach through the Medium-Term Management Plan 2021–2025 (MTMP). The action plans, which outline efforts to accelerate growth and shape the Group’s structure from FY2025 onward, mark a significant milestone toward achieving our Ideal Group Image for 2030.

To date, the Company has viewed the acquisitions of Sunoco LP in 2018 and Speedway LLC in 2021 as major steps toward global growth. Since then, we have intensified our focus on domestic and overseas CVS operations while implementing the business portfolio reforms outlined in our MTMP.

I believe that a key driving force behind these initiatives has been our new governance structure, introduced in FY2022, where independent outside directors comprise the majority of the Board of Directors. The outside directors, who take a broad view of the business and objectively discuss both the present and future while emphasizing the shareholders’ perspective, have made critical observations. They pointed out the need for a clear roadmap for the fundamental transformation of superstore (SST) operations and raised concerns that having domestically focused SST operations and global CVS operations under the same umbrella could reduce capital efficiency. Although we were aware of these issues, we tended to prioritize internal matters. The objective opinions of the outside directors, free from internal biases, provided us with new insights and raised our awareness of these issues, significantly pushing us toward more informed decision-making.

Following such candid discussions, in March 2023 we announced the Results of the Group Strategy Reevaluation, highlighting our decision to focus management resources on a CVS strategy centered on our strengths in food. We also updated our MTMP targets accordingly.

These action plans were carefully considered by the Company based on recommendations from the Strategy Committee, which is composed solely of independent outside directors. Over the past year, the Strategy Committee held 13 formal meetings and, including informal discussions, a total of 17 sessions, dedicating substantial time and effort to the process. At the Board of Directors’ meeting, in response to the recommendations, we reaffirmed the positive vision for the Group beyond the new perspectives presented. Acknowledging the Strategy Committee’s enthusiasm, we took the time to thoroughly and carefully discuss and finalize our action plans.

Becoming a world-class retail group centered on the 7-Eleven brand

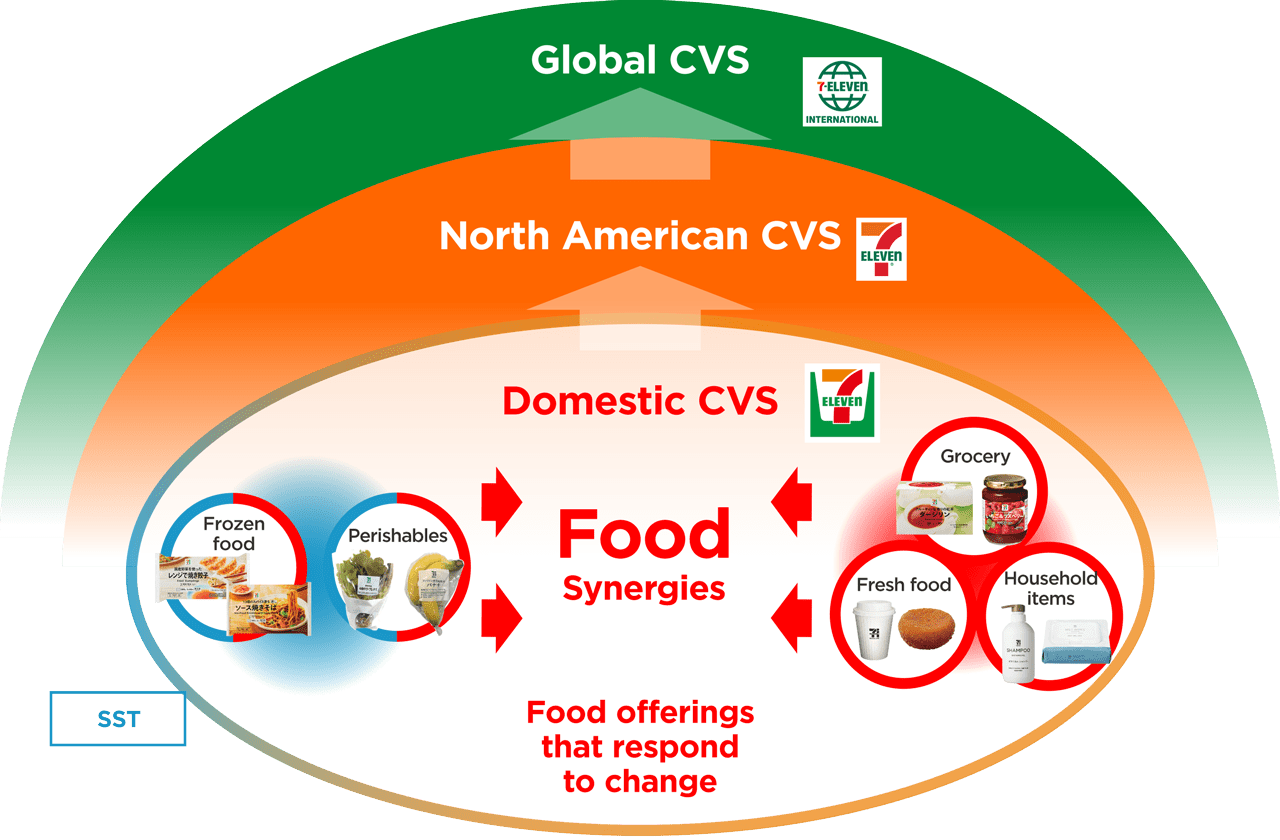

The major goal of our concrete action plans to accelerate growth is to leverage our strengths in food, which is the starting point of our Group’s competitiveness, to elevate the 7-Eleven brand to a globally recognized level.

SEVEN-ELEVEN JAPAN CO., LTD. (SEJ) has achieved high brand loyalty, with average daily sales approximately 30% higher than the average of domestic competitors. This is largely attributed to SEJ’s differentiation through original fresh foods and fast foods. In addition, the strong synergy effects achieved by having SST operations within the Group, which specialize in frozen food and perishables, have contributed significantly. SST operations offer wide-ranging product lines unmatched by CVS operations, supported by an extensive procurement network involving various suppliers, from perishables to processed foods. By leveraging such insights and networks to the fullest, we have established a Team Merchandising (Team MD) framework to develop the Group’s private brand, Seven Premium. This approach has enabled us to increase the proportion of proprietary merchandise that offers distinctive flavor and value. In fact, there is a strong correlation between the sales composition of fresh foods and the number of store visits in 7-Eleven business worldwide.

In response, the Group is currently focusing on building a value chain for food, which is key to growth. We are working alongside SEJ, 7-Eleven, Inc. (SEI), which manages CVS operations in North America, and 7-Eleven International LLC (7IN), which manages CVS operations worldwide. As a result, in North America, fresh foods made at a production facility for daily items in Virginia saw double-digit growth in FY2023. Additionally, in the Vietnam business we invested in 2023, we have strengthened our proprietary merchandise and achieved higher average daily sales than competitors despite being a late entrant. This reflects the tangible results of our evolution toward becoming a global food-focused convenience store.

The value chain-building capabilities developed by SEJ are a core competence of the Group. By expanding this expertise from Japan to North America and further worldwide, we aim to establish brand loyalty as a world-class retail group centered on the 7-Eleven business.

Start of Global CVS Steering Committee activities

At the outset of the action plans, we established a framework to promote the growth of domestic and overseas CVS operations more efficiently, effectively, and swiftly. Central to this framework is the Global CVS Steering Committee, where leaders from SEJ, SEI, and 7IN come together to pool their accumulated knowledge and expertise to develop optimal strategies. I lead these discussions as the head of the committee.

As the cash generation capacity of the 7-Eleven business grows, it becomes crucial to determine where to invest, with what objectives, and in which initiatives to prioritize in order to maximize corporate value and shareholder value. For example, in the globalization efforts led by 7IN, we are refining a roadmap for expansion by reassessing the entire process—from criteria for selecting countries and regions to finalizing contracts with local partners—to focus on the most promising areas for development.

We are also looking closely at operational aspects, investing in non-financial capital such as talent development and IT utilization, while sharing insights across the Group. For example, in IT and digital transformation (DX), by utilizing SEI’s extensive experience and expertise in initiatives like 7NOW, mobile checkout, and retail media, we are taking the lead in supporting the implementation of systems tailored to the store expansion needs of SEJ and 7IN. In addition, under the theme of “food reinforcement,” employees of SEJ and domestic business partners travel to North America and various Asian countries to support the development of local value chains. By synchronizing our business strategy with IT/DX and human resource strategies, we aim to maximize effectiveness and achieve significant impact.

Clarifying direction for the optimal Group structure

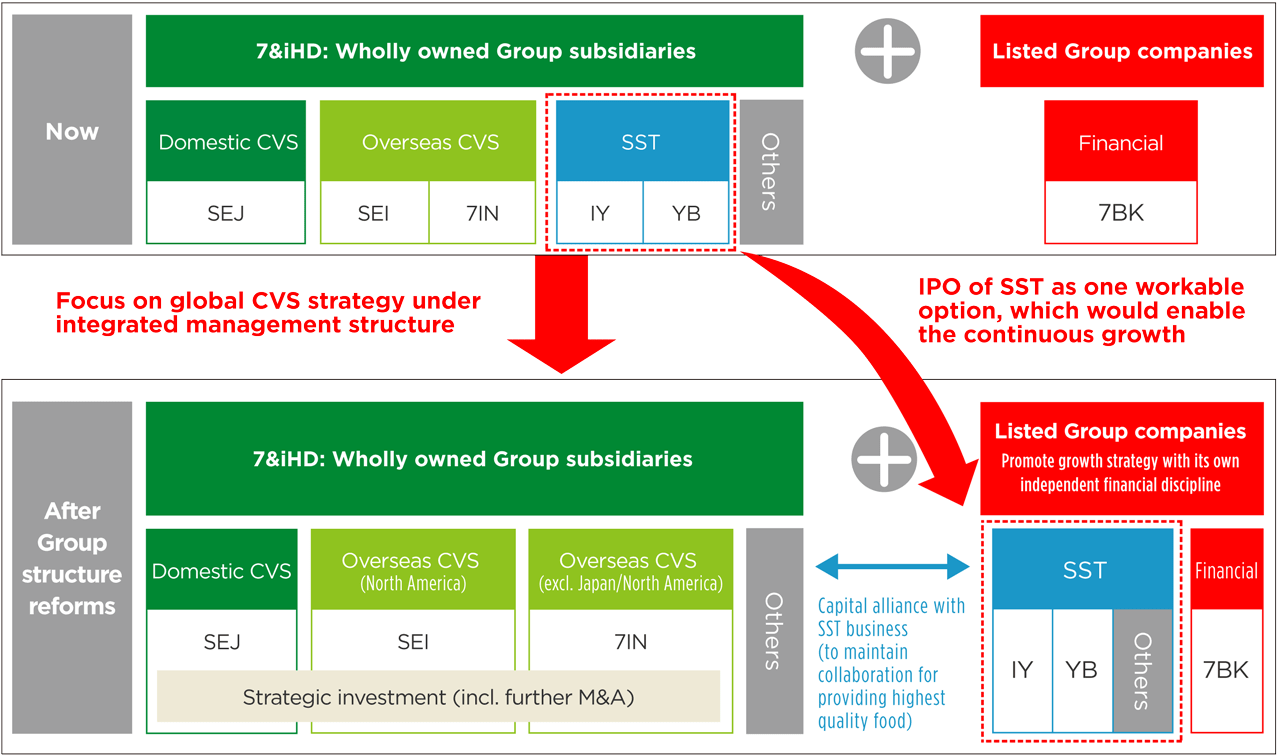

In the action plans, we have also outlined the direction for an optimal Group structure aimed at achieving long-term growth and enhancing corporate value and shareholder value, beyond the fundamental transformation of SST operations.

In SST operations, we are considering a realistic and timely initial public offering (IPO) as a workable option enabling long-term growth. Given that our strengths in food are the cornerstone of the Group’s growth, we aim to retain a certain stake in SST operations and maintain a collaborative framework between SST and CVS operations in the food development domain.

With the IPO, SST operations will be able to define their own growth direction under financial discipline as an independent entity. Employees will also be able to build their careers with a stronger awareness of both the business’s growth and their own development. This engagement between the company and its employees is expected to play a significant role in achieving sustainable growth following the reforms.

At the same time, domestic and overseas CVS operations, which account for approximately 90% of the Group’s EBITDA, will be able to allocate their accumulated cash more intensively toward growth investments. I am confident that this plan, which allows both CVS and SST operations to focus on their respective businesses, will lead to the maximization of long-term value for stakeholders.

Further reinforcing governance structure

It is our hope that the action plans will be discussed in greater depth and with greater frequency in the future, as the board of directors continues to monitor it. While the execution of measures devised from these discussions will be handled by the executive team, we have decided to separate the roles of the chairperson of the Board and CEO. This change aims to maintain the objectivity and transparency of Board discussions and to enable swift deliberation on the broad themes of the action plans.

The newly appointed Board Chairperson, Stephen Hayes Dacus, possesses extensive global experience and a high level of knowledge in the retail industry. His performance to date as chairperson of the Strategy Committee also makes him well-qualified for the role of chairperson of the Board. We are confident that his continued collaboration with us will significantly contribute to enhancing the Company’s corporate value and shareholder value.

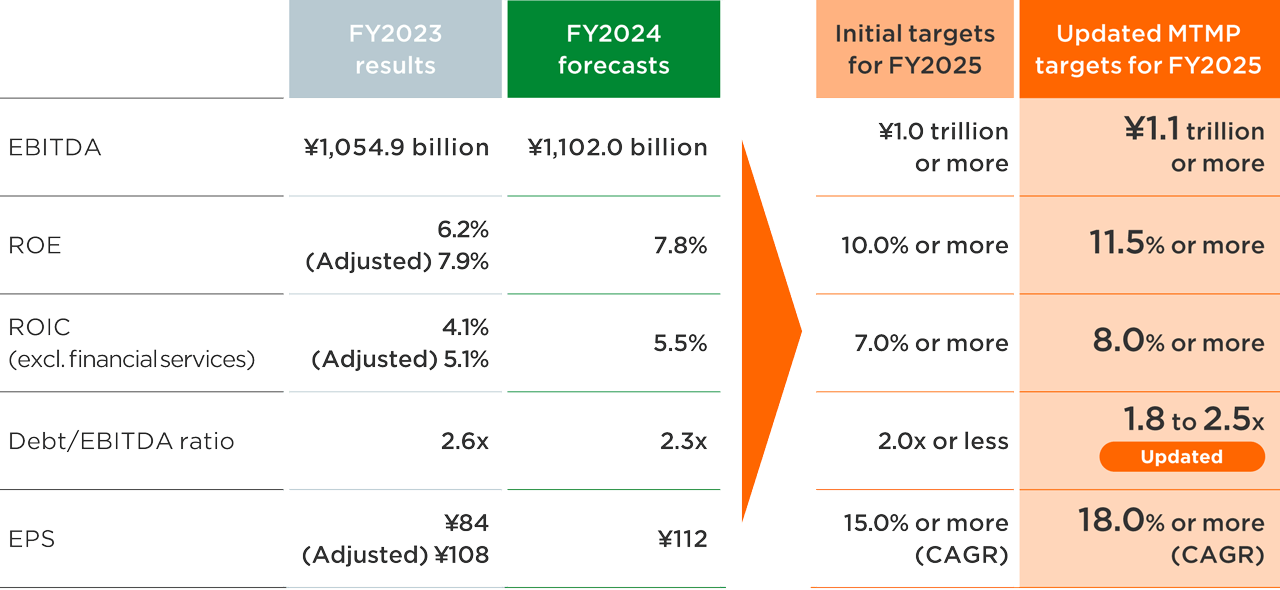

Improving qualitative indicators based on consolidated financial KPIs

To enhance corporate value, we have established financial key performance indicators (KPIs) based on both quantitative and qualitative metrics. For quantitative expansion, we focus on EBITDA, operating cash flow (excluding financial services), and earnings per share (EPS) growth rate. For qualitative improvement, we track return on equity (ROE) and return on invested capital (ROIC) (excluding financial services). In terms of financial soundness, we use the Debt/EBITDA ratio as a KPI and are thus actively working toward achieving our targets for FY2025.

Among these, we particularly recognize the need to improve qualitative indicators such as ROE and ROIC. Enhancing capital efficiency requires boosting profitability, particularly in domestic and overseas CVS operations, to improve ROIC. Effectively implementing the concrete action plans to accelerate growth is essential for achieving this objective. Improving profitability in North American CVS operations is considered an urgent priority. We are intensifying the monitoring of strategic execution from both short-term and long-term perspectives to address this challenge and enhance profitability.

From the standpoint of optimizing the capital invested, we are accelerating the reorganization of unprofitable assets. We will also rigorously monitor investments and returns related to resource allocation for growth, taking appropriate actions to improve capital efficiency.

- Notes: 1. Adjusted: Adjusted figures for the effects of the transfer of the shares of Sogo & Seibu and Barneys Japan

- 2. ROIC (excluding. financial services): {Net income + Interest expense x (1 - Effective tax rate)} / {Owner’s equity + Inter-est-bearing debt (both the averages of the figures at the beginning and the end of each fiscal year)}

- 3. Debt/EBITDA ratio: We changed our FY2025 target to proactively implement strategic investments in the Convenience Store business with a more agile and flexible financial discipline, in order to promote the growth strategy of our Group.

- 4. The Company conducted a 3-for-1 common share split on March 1, 2024. “EPS” is calculated as if the share split had occurred at the beginning of previous consolidated fiscal year

Approach to capital allocation

As business and profit growth progress steadily and cash flow increases, investment decisions will be guided by capital efficiency criteria to enhance corporate value and shareholder value. Our fundamental approach is to concentrate investments on strategic areas, with a primary focus on overseas CVS operations, which are key growth drivers for the Group.

Additionally, to remain agile and flexible in responding to high-quality strategic investment opportunities, we have adjusted the Debt/EBITDA ratio range from below 1.8 times to between 1.8 and 2.5 times.

For shareholder returns, we will introduce progressive dividends that increase in line with sustainable profit growth, aiming for a total return ratio of 50% or more for the cumulative period from FY2023 to FY2025.

We have begun discussions on the next medium-term management plan based on our capital allocation strategy.

Expanding opportunities for dialogue with investors

Regarding our action plan for enhanced investor engagement, we have increased direct dialogue opportunities by hosting our inaugural IR Day fall 2023 and visiting institutional investors in North America, Europe, and Asia twice a year. While these efforts have been highly praised by outside directors, it has also been noted that there is a gap compared to global best practices.

We will enhance the quality of our investor and shareholder relations activities to deepen understanding of our management strategy, which is aimed at achieving the Group’s vision. Our goal is to cultivate expectations for increased corporate value and shareholder value through sustainable growth.

Supporting employees’ career development based on a future roadmap

Amid significant changes in the Group’s structure, maintaining and enhancing the motivation of our human resources is one of our most critical challenges. In the retail industry, the importance of employee engagement, particularly for those who interact closely with customers, is certain to increase in the future.

To achieve this, it is essential to evolve into a workplace where diverse employees feel both fulfilled and comfortable in their roles. It is also important to support employees in visualizing their desired future and proactively shaping their careers based on the Group’s direction, while fostering a workplace culture where they continuously take on challenges with the customer’s perspective in mind.

Through these efforts, it is our role as management to connect employees’ motivation to the Group’s competitiveness. We aim to support individual career development and job satisfaction with more concrete systems and measures, and we intend to deepen our dialogue with employees to achieve this goal.

Sustainability strategy aligned with the growth strategy

The Group’s global supply chain is expanding, and we are increasingly conducting business in regions with different lifestyles and business practices. In this context, to embody the vision of becoming a world-class retail group, it is essential to establish systems across all parts of the supply chain, including outsourced manufacturing, that ensure robust protections for human rights and the environment.

To realize this, we continuously focus on the results of our CSR audits and discuss the types of business partners that require re-audits and the trends observed among them. In the past, there have been cases where we suspended transactions with contract manufacturers of private-label products due to issues such as child labor and unpaid overtime. We will continue to monitor these matters closely moving forward.

While we focus on fortifying our defenses, we also emphasize a proactive approach by concentrating on opportunities within our seven material issues. This includes promoting the widespread adoption of merchandise and services that address local social issues. From this perspective, we believe that expanding the 7-Eleven business, which has become an integral part of Japanese society, to a global scale is crucial for integrating our growth strategy with our sustainability strategy. This involves promoting product safety and reliability and other measures as part of GREEN CHALLENGE 2050, the Seven & i Group’s environmental declaration, encouraging the employment of seniors and persons with disabilities, and providing various forms of social value, including community support programs.

Becoming a glocal brand tailored to customers’ lives around the world

The Seven & i Group began in 1920 with the clothing store Yokado, and over the years, we have significantly evolved our merchandise, services, and business operations to adapt to changing times and customer values.

SEJ, which I joined in 1980, is now the driving force behind the growth of the Group, which is now the 7th largest retail group in the world in terms of Group sales*, including sales by franchisees, and I am very happy that the entire Group is developing businesses that are deeply tailored to customers' lives, with a focus on food.

We will remain steadfast in our commitment to pursuing valuable merchandise and services essential to daily life, along with upholding the management principle of responding to change while strengthening fundamentals. Similarly, our Corporate Creed, centered on trust and sincerity, and our fundamental approach of providing new experiences and values, will continue to be the foundation and driving force of our growth.

Building on the unique characteristics of the Group, we will continue to engage with our stakeholders, think critically, and take action to achieve sustainable growth. Our goal is for stakeholders to want to experience our merchandise and services, support us as shareholders, and seek opportunities to work with us. We will steadily implement our action plans to make this vision a reality.

* The Group’s total sales include the sales of franchisees of SEJ, SEVEN-ELEVEN OKINAWA CO., LTD., and SEI.