- Top

- Sustainability

- Corporate Governance

Corporate Governance

Seven & i Holdings is committed to strengthening corporate governance and maximizing the corporate value of the group as a holding company that supervises and oversees its subsidiary companies.

Basic Views on Corporate Governance

Seven & i Holdings considers corporate governance to be a system for sustainable growth by establishing and maintaining a sincere management structure and continuously increasing the Group's corporate value over the medium and long term in both financial and non-financial (ESG) aspects to ensure the trust and longstanding patronage of all stakeholders, including customers, business partners and franchisees, shareholders and investors, local communities, and employees, based on the Corporate Creed. Seven & i Holdings' mission as a holding company is to strengthen corporate governance and maximize the Group's corporate value, and Seven & i Holdings will strive to achieve this mission through the provision of support, oversight, and optimal resource allocation to its operating companies.

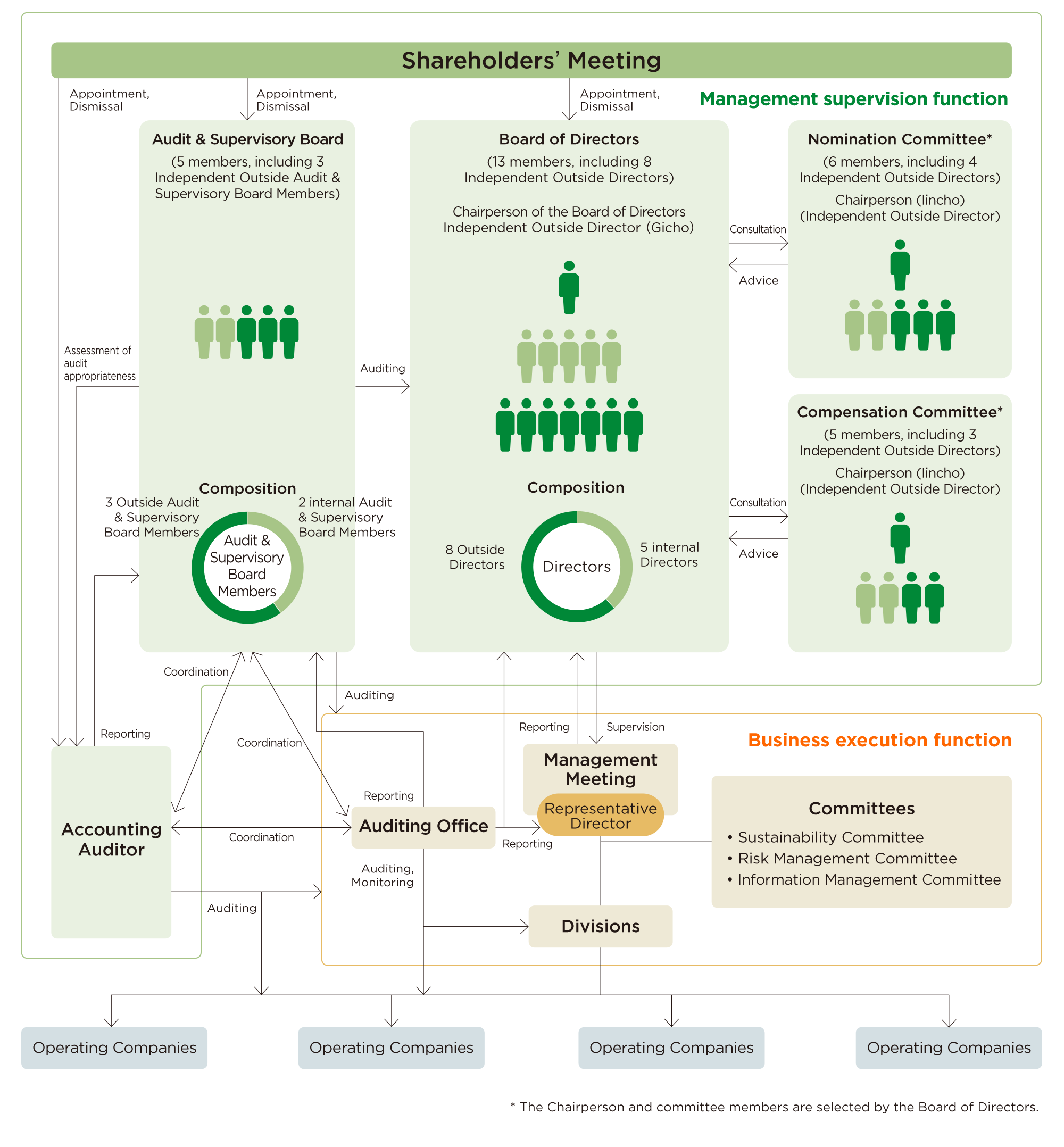

Seven & i Holdings ensures the effectiveness of its corporate governance by coordinating "audits" conducted by the Audit & Supervisory Board Members (Audit & Supervisory Board), including multiple Outside Audit & Supervisory Board Members who maintain their independence and have specialized knowledge in such areas as legal affairs and financial accounting, through their actively cooperating with the accounting auditor and the internal audit division, and "formulation of management strategies" and "supervision of business execution" conducted by the Board of Directors, including multiple Outside Directors who maintain their independence and have advanced management knowledge and experience. Seven & i Holdings has adopted this corporate governance structure because it judges the structure to be workable for realizing and ensuring Seven & i Holdings' corporate governance and for conducting appropriate and efficient corporate management.

Seven & i Holdings Corporate Governance System (as of May 27, 2025)