- Top

- Company

- Quarterly Shareholder Report Feature

- Vol.166

- Plan for Transformation of 7-Eleven (Overview)(September 2025)

special feature

Plan for Transformation of 7-Eleven (Overview)

Redefining How We Do Business and Pursuing a Next-Generation Business Model

September 2025

Enhancing Management: Formulating Our Transformation Plan

As we transition to a new structure dedicated exclusively to the convenience store (CVS) business, we have formulated the Transformation Plan to pivot our operations toward creating customer value, deliver new customer experiences, and enhance returns to our shareholders. Through this transformation, we will build an organization that is both agile and lean, ready for challenges ahead.

For decades we have expanded the 7-Eleven business globally and sustained a market-leading position. Alongside many successes, however, risks have emerged in recent years: a slowdown in innovation and the drive toward execution. The new leadership team of Seven & i Holdings shares a deep sense of urgency on this issue and recognizes the need to rapidly change how we run the business.

To that end, we have engaged in close, continuous dialogue with the leadership of our operating companies and, working as one, focused on developing the Transformation Plan together. The plan clarifies the major initiatives, their priorities, the timeline, and goal. To ensure disciplined execution, we will introduce rigorous and transparent management processes. As the company transitions as described at the outset, we will transform how the parent and our operating companies are managed to pursue further growth.

Rekindling our founding spirit and accelerating self-driven innovation

To drive this transformation, we will reaffirm our unchanging fundamental values established by our founders, "Trust & Sincerity" and "Embracing Change". We will nurture a culture across the Group that is humble in learning and aggressive in driving change.

Over our history, we have delivered numerous innovations in retail, from product and service breakthroughs such as Seven Premium, Seven Café and in-store ATMs, to distinctive methods like Tanpin Kanri (item-by-item management), or the Retailer Initiative and our proprietary supply chain management. In recent years, however, the pace of innovation has slowed. Now is the time to redefine our business, to challenge ourselves, to think and act differently. When every colleague thinks and acts like a founder, we will accelerate our innovation and growth.

The company-wide cultural redefinition and the transformations set out in this plan will be driven by the leadership team (see this) working in close concert with the leadership teams of each operating company, operating as One Team.

Identifying the management issues that require immediate action

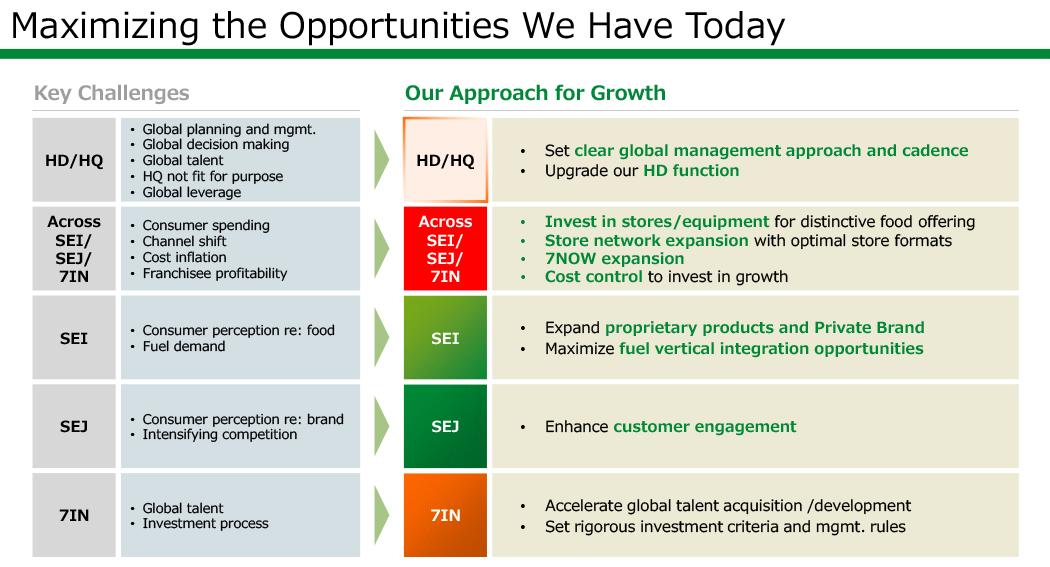

In developing the Transformation Plan, the management team held numerous discussions with each operating company and identified the issues that require urgent attention.

1 Strengthening management processes for the global business

First, our approach to managing the global business. Historically, we lacked an integrated, enterprise-wide management process. The oversight by Holdings and coordination among operating companies were insufficient. This lack of coherence and clarity hindered execution and slowed decision-making. By introducing a new global management process, operating company leadership teams will have clear ownership of the KPI targets and be empowered to act with greater autonomy, with progress reviewed and assessed regularly.

We will also establish Centers of Excellence (CoE) that leverage functions such as technology, digital transformation, talent management, supply chain, and operations, enabling best practices to be shared globally and strengthening each operating company’s competitive advantage in core businesses. This will allow us to maximize existing advantages and potential at a global scale and deliver outcomes.

At the same time, we will streamline and refocus headquarters, shifting from a diversified conglomerate posture to a concentrated support model, creating a leaner structure. This includes plans to reduce costs by approximately JPY 40 billion by 2030.

2 Maximizing growth opportunities of each operating company

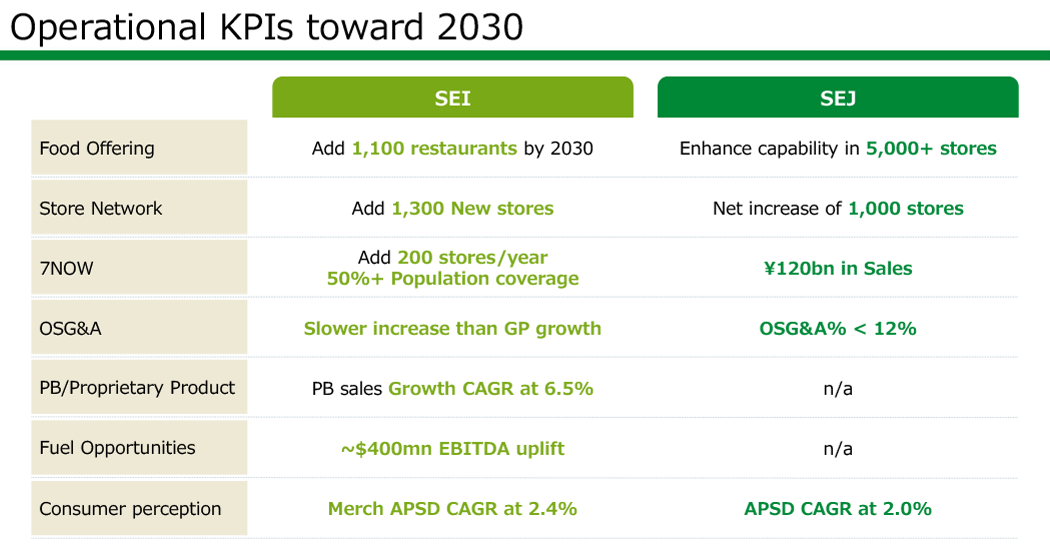

Across Seven-Eleven Japan (SEJ), 7-Eleven, Inc. (SEI), and 7-Eleven International LLC (7IN), we identified seven issues that represent major global initiatives capable of generating substantial value over the coming years. We developed plans with each operating company through thorough debate to define KPIs, key deliverables, milestones, and accountabilities.

1 Invest in stores and equipment to enable differentiated fresh food

SEJ’s counter-served fresh food, such as “Seven Café Bakery”, is delivering strong results. We will invest JPY 300 billion over the next five years in necessary stores, equipment, and other.

SEI will approximately double the number of restaurant-adjacent stores in the next five years.

2 Expand the store network

We will accelerate openings in both North America and Japan. Leveraging diverse formats to meet local needs, SEJ will add a net 1,000 stores over five years and increase the opening pace by 40%. *

SEI will accelerate new large-format openings from 125 per year to 250+ and add a further 1,300 stores over the next five years.

* Comparison of FY2019 vs. FY2024.

3 Scale and strengthen "7NOW"

Customers increasingly expect new shopping experiences. SEI’s on-demand delivery service "7NOW" already operates at roughly 7,500 stores across the U.S. and is expected to reach about 50% population coverage shortly. 7NOW has the potential to redefine the next generation of CVS, offering a differentiated experience that resonates strongly with customers.

SEJ is also rolling 7NOW out nationwide and will further expand participating stores to make it a true source of competitive differentiation.

4 Tight control of controllable levers to reinforce our edge

Macroeconomic conditions and other externalities introduce uncertainty. To deliver steady growth, we must rigorously manage what we can control, especially OSG&A. We will redeploy savings into areas where customers perceive value, strengthening our competitive position.

SEI has already intensified such discipline since FY2024, contributing to higher net profit.

SEJ has launched a company-wide effort this year to drive change across the entire value chain, with expected benefits to profitability.

5 SEI Strengthen original products and private brands (PB)

Original and private-brand products offer superior margins, quality, and growth relative to national brands (NB), delivering true competitive advantage. We will further reinforce PB in both Japan and North America. In North America, where this field remains underdeveloped, we will bolster the right talent and processes, and over the next several years aim to raise PB product sales growth to three times the overall sales growth, driving both stronger customer affinity for our brands and higher margins.

6 SEI Vertical integration of the fuel business

As the largest gasoline retailer in the U.S., SEI will leverage its talent, governance, technology, and organizational capabilities to create added value. By securing access to logistics infrastructure and optimizing the network, we plan to enhance profitability.

7 SEJ Deepen customer engagement

In Japan, brand equity among younger consumers has declined.

SEJ management recognizes this and is acting to improve brand image swiftly through an integrated approach spanning product development, in-store activity, and communications. Seven & i Holdings will support this with resource reallocation and other measures to build more proactive, unified communications, strengthening engagement with customers.

Building a next-generation business model for customers and franchisees

The final element of the Transformation Plan is to harness technology and vast data to deliver a more convenient and compelling shopping experience for customers, while simultaneously improving the productivity and profitability of individual stores, including our franchisees.

We operate a network of over 30,000 stores across Japan and North America and welcome 30 million customers daily. On the other hand, we have not yet fully capitalized on technology, AI adoption, data analytics, and more. By driving innovation in this area, we will open up opportunities to gain further competitive advantage. With the support of partners, we will actively deploy new technologies to elevate the customer experience and realize new business models that also generate returns for our partners.

This will not be achieved overnight, but sustained focus and commitment are essential. We will craft a global technology strategy and establish Center of Excellence to support business transformation. As expectations of convenience evolve rapidly, we are determined to lead that change.

Maximizing long-term shareholder value

By executing this Transformation Plan, we will introduce strict processes and a framework to manage business performance. This framework will enable operating companies to decide and act with speed, while giving Holdings a holistic, balanced view to manage the portfolio and focus on capturing opportunities in front of us.

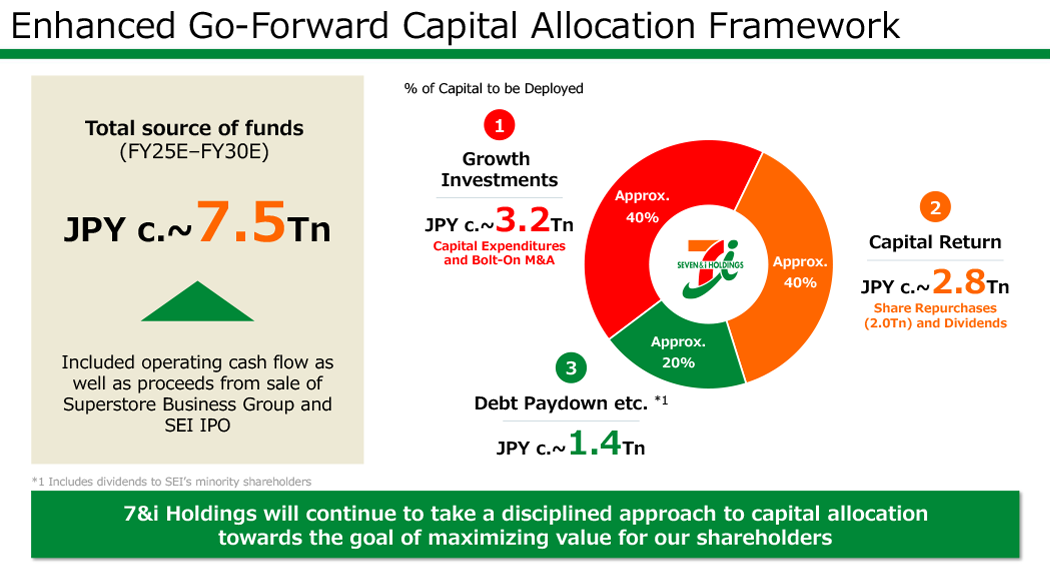

We are committed to disciplined capital allocation and to an algorithm that maximizes long-term shareholder value.

Through these transformations and through day-to-day execution, we are confident that we can deliver shareholder returns far exceeding those of the past.