- Top

- Sustainability

- Compliance

Compliance

Seven & i Holdings places absolute priority on compliance with laws and regulations and social norms. We also strive to ensure that its corporate governance is functioning soundly and secured by management.

Seven & i Holdings Corporate Action Guidelines

The Seven & i Holdings Corporate Action Guidelines present the behavior that each employee should practice in order to realize the spirit of "trust and sincerity" expressed in the Group's corporate creed. The guidelines call for employees to comply with laws, regulations, and social norms, to uphold laws and regulations such as the Act on Prohibition of Private Monopolization and Maintenance of Fair Trade as well as internal rules, conduct business under appropriate conditions in line with sound trading practices, and not to have any contact with antisocial groups.

- Basic Policy

-

- 1Provision of Safe and High-Quality Products and Services

- 2Maintenance of Fair and Transparent Transactions

- 3Cooperation with Local and International Communities

- 4Respect for Human Rights

- 5Respect for Diversity and Improvement of Job Satisfaction

- 6Preservation of the Assets and Information of the Company

- 7Contribution to a Sustainable Society

- 8Dialogue with Stakeholders

- 9Efforts Regarding Social Issues

- Code of Corporate Conduct

-

- 1Compliance (Legal Compliance)

- 2Relationships with Customers

- 3Relationships with Business Partners

- 4Relationships with Shareholders and Investors

- 5Relationships with Local and International Communities

- 6Relationships between the Company, and Directors, Officers, and Employees

- 7Preservation of Global Environment

Compliance System

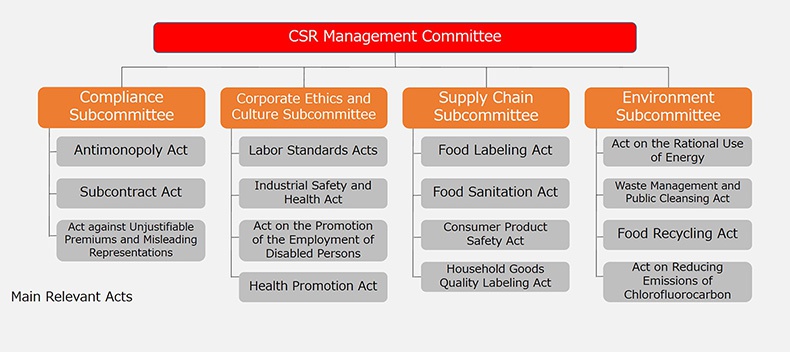

Seven & i Holdings has a CSR Management Committee, chaired by the President, and four subcommittees - Compliance Subcommittee, the Corporate Ethics and Culture Subcommittee, Supply chain Subcommittee, and the Environment Subcommittee. These subcommittees work together with each Group company to promote the Seven & i Holdings Corporate Action Guidelines and to rigorously enforce compliance.

Internal Whistleblowing System

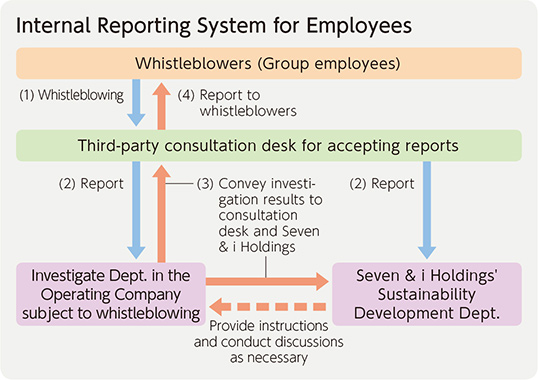

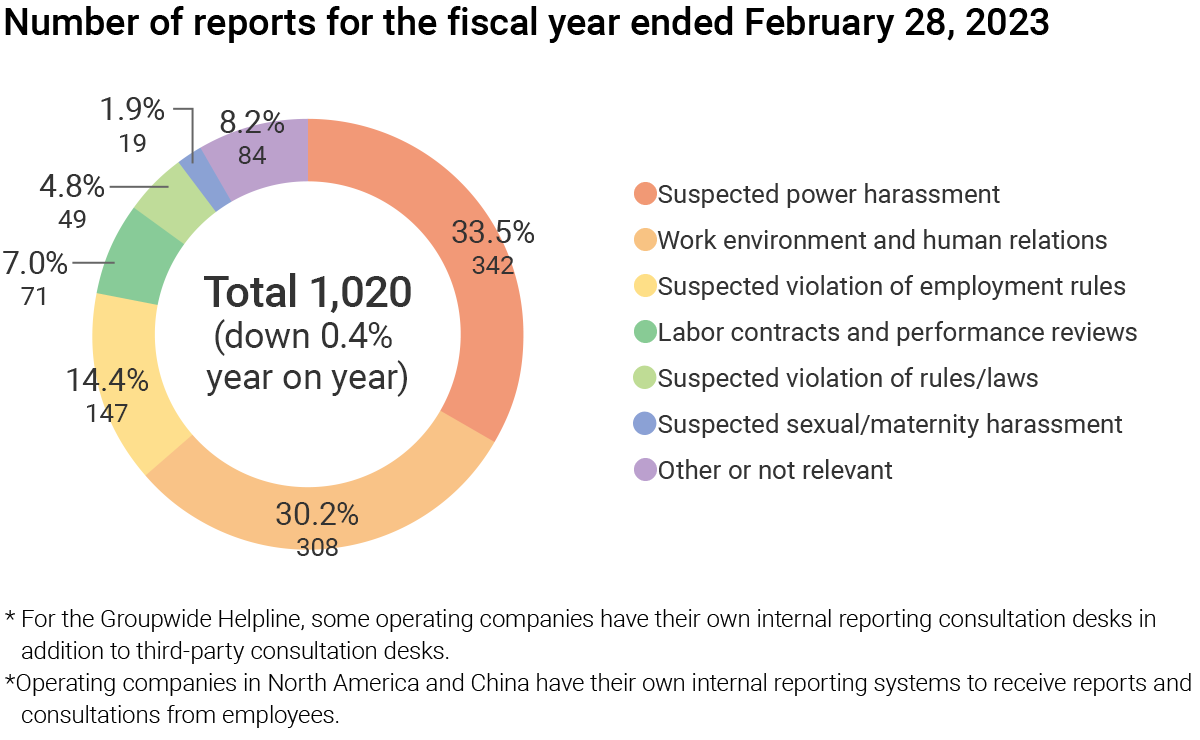

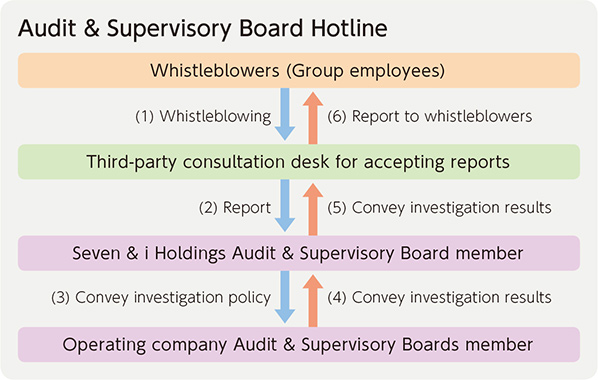

Seven & i Holdings has set up the Groupwide Employee Helpline, the Business Partner Helpline, and the Audit & Supervisory Board Hotline to prevent conduct that could result in loss of public credibility and to ensure early detection, early remediation, and recurrence prevention. The Groupwide Employee Helpline is for receiving reports from employees of operating companies in Japan, the Audit & Supervisory Board Hotline is for reports related to management, and the Business Partner Helpline is for reports from business partners.

The three internal reporting systems have a consultation desk operated by a third party under a service contract and a non-disclosure agreement to protect the privacy of people consulting or whistleblowing, and ensure that the content of their reports is not disclosed publicly or leaked. The consultation desk accepts reports via email, telephone, or post. (Reports via telephone are only accepted during service hours.)

Once a whistleblowing is received, the company subject to the whistleblowing quickly confirms the facts, corrects any violations that are found, and strives to prevent a recurrence. To create an environment that facilitates reporting, reports can be made anonymously, and our operating regulations stipulate that whistleblowers are not to be subjected to disadvantageous treatment for having made a report. The person is contacted at the end of the month following notification of completion of the case by the third-party consultation desk to check that they have not suffered retaliation or disadvantageous treatment.

Seven & i Holdings' Sustainability Development Department keeps track of the number and nature of the reports for each Group company, as well as the status of responses, to ensure that the actions taken by the operating companies are appropriate. In the event of a serious violation or other such incident, a report will be provided immediately to the Representative Director, responses will be discussed with the relevant divisions and companies, and the necessary response measures will be taken. In addition, the CSR Department reports on the operational status of the internal reporting system to Seven & i Holdings' Board of Directors.

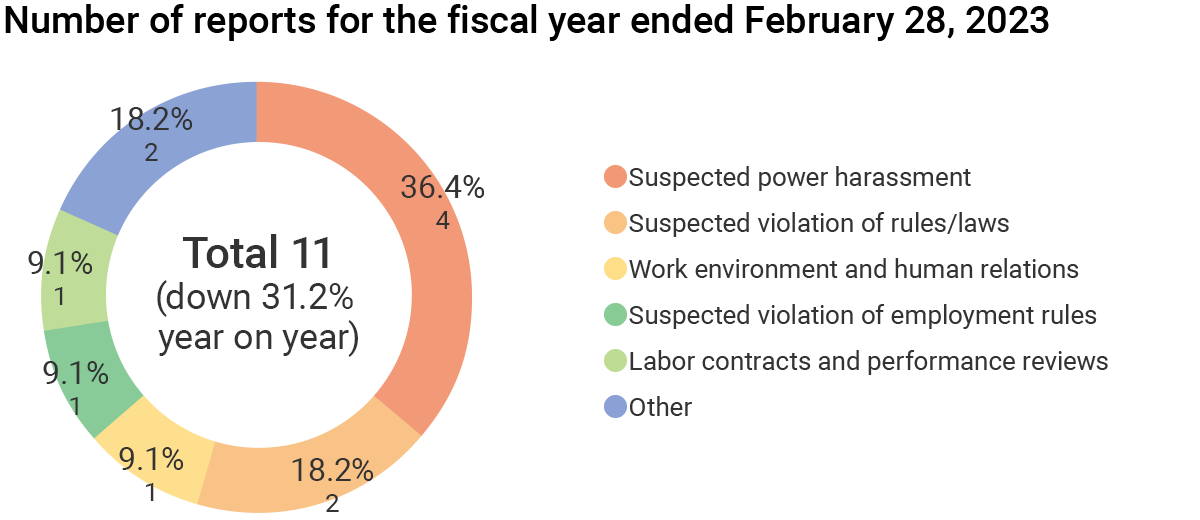

Groupwide Employee Helpline (Internal Whistleblowing System for Employees)

The Groupwide Employee Helpline can be used by Group employees, Directors and Audit & Supervisory Board Members, and retirees and their families. To ensure that all employees are aware of the system and its contact points, it is explained in employee training and on the intranet, and posters are put up in every workplace and store. Additionally, employees' awareness of the Groupwide Employee Helpline is surveyed as part of the Employee Engagement Survey administered once every two years.

Procedural Flow for the Groupwide Employee Helpline

The Audit & Supervisory Board Hotline has been in operation since February 2019 for the purpose of receiving reports independent of management related to actions that could potentially result in the loss of social trust in which the directors, members of the Audit & Supervisory Board, executive officers, and other members of management for Group companies in Japan are suspected of being involved, and investigating them. When the Company receives a report, it quickly confirms the facts, and the members of the Seven &i Holdings Audit & Supervisory Board work together with the members of operating company Audit & Supervisory Boards to correct any violations that are found and strive to prevent a recurrence.

Procedural Flow for the Audit & Supervisory Boad Hotline

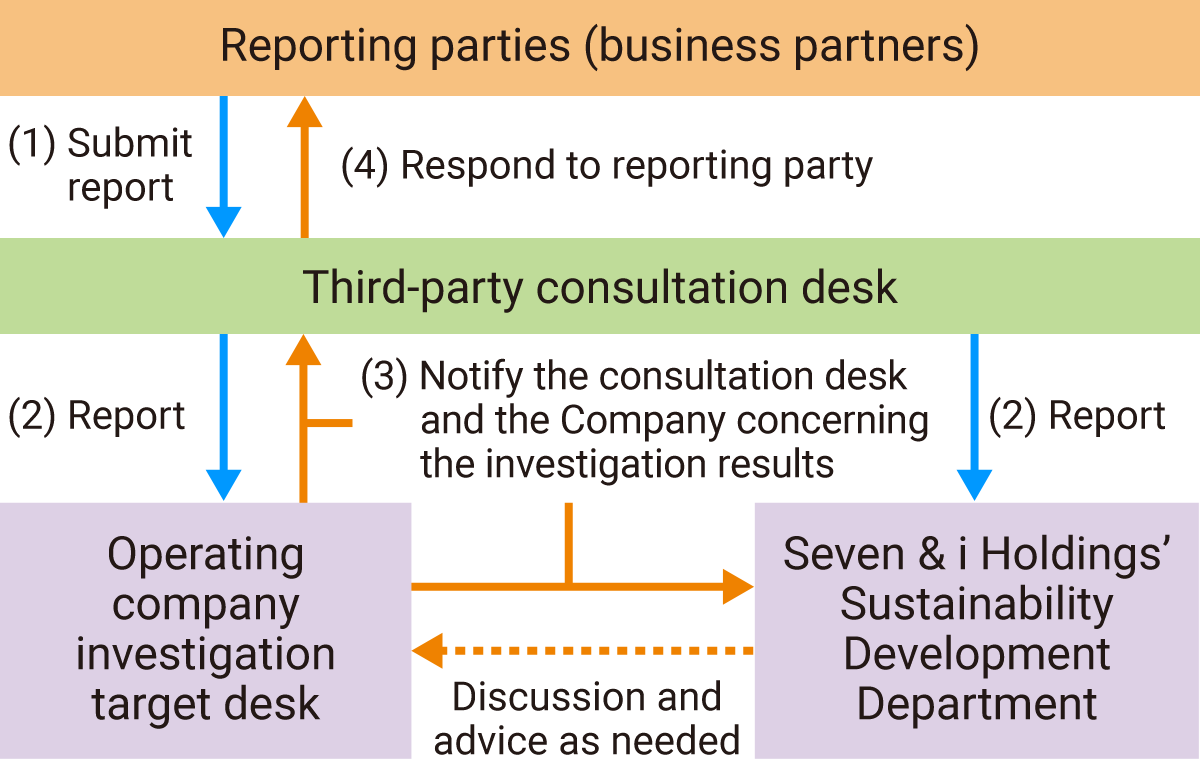

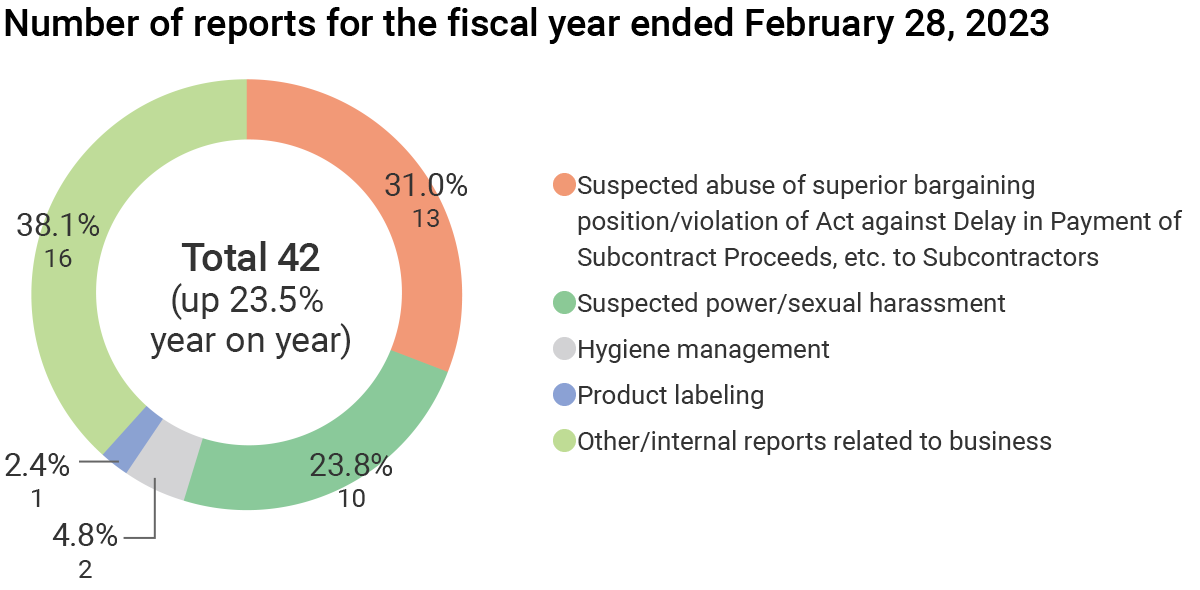

Business Partner Helpline (Internal Whistleblowing System for Subcontractors)

The Business Partner Helpline can be used by Directors and Audit & Supervisory Board Members, employees, and former employees of domestic Group companies' business partners. To ensure that business partners are fully aware of the helpline system and its points of contact, we explain it at briefings for business partners and distribute information in pamphlets.

Procedural Flow for the Business Partner Helpline

Compliance Education and Training of Employees

Seven & i Holdings and Group companies endeavor to promote and foster understanding of the Seven & i Holdings Corporate Action Guidelines among all employees. To this end they have prepared specific guidance for employees on how to put the guidelines into practice in line with the business characteristics of each company. In addition, when undertaking tier-specific group training for organizational levels ranging from new recruits to management, Seven & i Holdings provides training based on the themes of the Seven & i Holdings Corporate Action Guidelines and compliance. From the fiscal year ended February 29, 2016, compliance seminars have been held every year for executives, beginning with the presidents of Seven & i Holdings and each Group company. In addition, starting in the fiscal year ended February 28, 2017, training via e-learning (some employees viewed DVDs) has been periodically undertaken for Group employees in Japan. In the fiscal year ended February 28, 2023, 4,162 employees took the training.

Compliance Awareness Survey

Seven & i Holdings prepares questions related to compliance and periodically conducts the Employee Engagement Survey, an anonymous biennial survey designed to gauge the extent of understanding of the Corporate Creed and compliance awareness among employees. The survey includes questions that measure job satisfaction and the degree of acceptance of performance reviews. Groupwide initiatives are implemented to address common issues across the Group that have been identified by the survey results. Along with this, Group companies devise measures to tackle the issues faced by each company and strive to make improvements accordingly. In the fiscal year ended February 28, 2023, interviews were conducted with 26 Group companies to confirm the occurrence, response, and improvement status of compliance incidents.

Anti-corruption

Seven & i Holdings is a signatory to "the UN Global Compact." Based on the spirit of "Trust and Sincerity" set forth in the Corporate Creed, the Seven & i Holdings is working on anti-corruption, including extortion and bribery, in compliance with the laws and regulations of the regions in which it operates.

The Seven & i Holdings Corporate Action Guidelines states, "We conduct transactions based on appropriate conditions by following sound business practices. No transactions should be made for personal gain or benefit." We prohibit the provision of gifts, entertainment, and financial benefits to public officials or persons equivalent thereto in Japan and overseas. We also prohibit the receipt of private benefits from business partners, and do not engage in any form of corruption or fraud, including bribery, illegal political contributions, money laundering, and embezzlement. As a member of the international community, we pay close attention to countries, regions, organizations, and individuals subject to international economic and trade sanctions. Each the Seven & i Group company has provided specific guidance for implementing the Seven & i Holdings Corporate Action Guidelines in accordance with its business characteristics and educates its employees.

The Seven & i Group reports any suspected violation of compliance, including corruption, to its superiors, and accepts reports from employees through the Groupwide Employee Helpline, an internal reporting system, and from business partners through the Business Partner Helpline. If a serious violation occurs, we report it to the Board of Directors and take disciplinary action in accordance with internal regulations. The status of compliance with the Corporate Action Guidelines is confirmed in the "Employee Engagement Survey" which is held every two years, and the "Business Partner Questionnaires" which are held every year.

In addition, we ask our suppliers to prevent corruption and conduct fair transactions in the "Seven & i Group Business Partner Sustainable Action Guidelines". We disseminate the guidelines at supplier briefings and confirm the progress of the guidelines through self-check sheets. In China and Southeast Asia, where CSR risks are high, we also conduct compliance training for suppliers of outsourced manufacturing of private-brand products.

System for Prevention of Noncompliance Regarding Business Practices

Seven & i Holdings, in its Compliance Subcommittee, is working to prevent violations by sharing information on the latest laws and regulations concerning business practices and measures to address cases of unfair business practices that have occurred at Group companies or other companies in the industry.

If a case of an unfair business practice occurs, or is suspected, the FT Information Sharing Committee and the Sustainability Development Department work together to check the facts with the department and business partners concerned. If any issues are found to exist, they are dealt with appropriately according to administrative guidance.

Prevention of Noncompliance at Group Companies

Each Group company has a division to rigorously ensure fair trading practices, such as the FT Committee headed by the company president. These divisions are responsible for training the personnel responsible for procurement as regards the laws and regulations related to contracts, such as the Antimonopoly Act and the Subcontract Act. The status of legal compliance at each Group company is confirmed through a monitoring survey of each Group company conducted by the FT Information Sharing Committee.

Prevention of Noncompliance Regarding Business Partners

In the final stage of negotiations with each business partner, to ensure there are no later disagreements between the personnel in charge of purchasing at each company and the representative of the business partner, the matters determined as a result of their discussions are recorded in a standardized format, with each party retaining a copy.

Moreover, the Seven & i Group conducts individual employee interviews led by the employee's supervisor once every six months. At the individual interviews of personnel in charge of purchasing, their compliance with fair business practices is evaluated and reflected in their compensation package. From the fiscal year ended February 28, 2017, the Seven & i Group has conducted questionnaire surveys of business partners to confirm whether the speech and behavior of employees toward business partners follow the Seven & i Holdings Corporate Action Guidelines. In these surveys, business partners reply to questions anonymously. In the fiscal year ended February 28, 2023, a total of approximately 10,900 representatives of business partners responded to questionnaire surveys issued by Group companies.

Protecting Personal Information and Appropriately Securing the Safety of Information Assets

Seven & i Holdings aims to be a sincere company that is trusted by its stakeholders, and it positions the safeguarding of personal information and the appropriate protection and security of information assets handled by the Group as an important priority and social responsibility of its management and operations and as mandatory for all executives and employees. Our company has established the Personal Information Protection Policy and the Basic Policy on Information Security, and it has made it mandatory for all employees to comply with relevant laws and regulations such as the Act on the Protection of Personal Information and internal rules to ensure appropriate business execution through the protection of personal information and the use of information assets.

Tax-Related Policies

The Chief Financial Officer (CFO) of Seven & i Holdings is responsible for tax management. Based on the Seven & i Holdings Global Tax Policy, Seven & i Holdings has a tax strategy that corresponds with its management strategies and carries out uniform company-wide tax management. In addition, we report significant tax-related issues to the Board of Directors.

Seven & i Holdings Global Tax Policy

Seven & i Holdings has a basic policy of establishing high-quality corporate governance systems at the Company and its Group companies, including overseas subsidiaries. The systems are designed to ensure sound, sustainable growth and to uphold public trust. To provide appropriate countermeasures for tax-related risks, including changes in the tax governance environment in Japan and overseas, reputational risk, brand value degradation, and corporate social responsibility, we have a tax strategy that corresponds with our management strategies, and we will carry out uniform company-wide tax management.

In line with the above, Seven & i Holdings has adopted the following global tax policy.

-

1Legal Compliance

Seven & i Holdings and its Group companies, including overseas subsidiaries, always comply with the taxation laws in the countries where they operate. Moreover, they also respect the intention of such laws by paying taxes appropriately as a way of contributing to the economic development of the countries.

To ensure that our compliance with tax-related laws and our tax management are appropriate, we follow the guidelines for developing internal controls for financial reporting to build and develop internal control systems that ensure appropriate accounting procedures and financial reporting. We also operate these systems appropriately and have inside and Outside Audit & Supervisory Board Members check and assess the effectiveness of the controls. -

2Ensure Transparency

Seven & i Holdings and its Group companies, including overseas subsidiaries, provide timely and appropriate disclosure of management data and tax payment status in accordance with the laws of each country where they have operations.

Moreover, the Company and its Group companies, including overseas subsidiaries, do not engage in tax avoidance practices (tax havens), which are excessive tax-saving activities such as transferring value to low-tax countries, and transactions between operating companies are conducted according to the arm's length principle. -

3Relationship with Tax Authorities

Seven & i Holdings and its Group companies, including overseas subsidiaries, strive to ensure transparency and reliability with regard to their tax obligations by responding in good faith to the tax authorities in the countries where they operate and international tax authorities.

Tax-Related Risks

Seven & i Holdings has evaluated the impact of tax obligation risks on future value creation. As a result, we recognize the risk from changes in accounting standards and tax systems, such as transfer pricing taxation as a financial risk, and the risk associated with M&A and business reorganizations as a business risk.

Financial Risks

The Group could encounter unforeseen introductions of new accounting standards or taxation systems, or changes to existing systems, which could affect its business performance or financial position.

Business Risks

The Group develops new businesses and reorganizes its Group businesses through M&As, business alliances with other companies, establishment of joint ventures, and so forth. However, if the Group's strategic investments do not achieve the initially anticipated effect and cannot meet their targets, its business performance and financial position could be affected.

Tax-Related Reports

Our Group is expanding new businesses and restructuring Group businesses through M&As, business tie-ups with other companies, the establishment of merged companies, and so on. However, if we are unable to attain the effects we originally hoped for from strategic investments and are unable to accomplish their objectives, there is a chance that this will have a negative effect on our Group's business results and financial situation.

Tax payment amount by country or region for the fiscal year ended February 28, 2023 (Millions of yen)

| Japan | US | Canada | China | |

|---|---|---|---|---|

| Revenues from operations | 2,930,711 | 8,461,981 | 362,919 | 66,510 |

| Income before income taxes | 162,799 | 243,865* | ▲982* | ▲3,232 |

| Corporation tax | 63,337 | 8,179 | 1,201 | ▲918 |

| Tax payment | 78,757 | 17,585 | 59 | 337 |

*The amount of income before income taxes in the US and Canada contains amortization of goodwill due to Japanese Generally Accepted Accounting Principles.